–

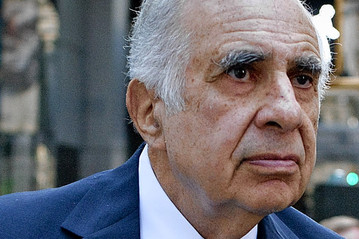

Carl Icahn/ Getty

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

–

In practical terms Carl Icahn threw in the towel some weeks ago in his fight against the Michael Dell and Silver Lake Partners buy-out of Dell Inc, which was subsequently approved by shareholders in a vote on September 12th, 2013. He even offered a back-handed compliment to Michael Dell along the way for out-manoeuvring him.

However from a formal point of view one of his earlier procedural steps still remained outstanding, namely his request before a Delaware Court to request an appraisal of his shares instead of the bid price. Under Delaware law shareholders who do not vote in a merger proposal have the right to request a formal appraisal of the value of their holding – a process that can take many months and which can offer no guarantee of a result higher than the bid price. Indeed in such event it could easily be lower.

Accordingly he has now delivered the coup de grace on his own opposition to the bid. Yesterday he tweeted on his now-famous Twitter account as follows: “I withdrew my demand for appraisal of my Dell shares. Based on our returns on capital, we believe we have better uses for $2 billion.”

And two days earlier Dell Inc. had filed the same information in an 8-K Current Report with the Securities and Exchange Commission as follows:

“On October 2, 2013, affiliates of Carl Icahn notified Dell Inc. that, as of such date, those entities have withdrawn their written demands for appraisal for all 156, 478, 650 shares of Dell common stock submitted pursuant to Section 262 of the Delaware General Corporation Law in connection with Dell’s pending going-private merger transaction approved by Dell’s stockholders on September 12, 2013.”

It seems Mr. Icahn now has better things to do in his, probably elusive, pursuit of a proposed US$150 billion, debt-funded, market share repurchase program he has put forward to Apple Inc. His proposal is unlikely to make much of an impact with Apple though, as it would certainly tend to adversely affect Apple’s own credit standing if it were implemented. Bond markets obviously have concluded the proposal may be going nowhere too, as their pricing of Apple’s existing bonds that were issued earlier this year have barely budged.

Read All About this Battle over Dell inc. :

- Michael Dell Wins Shareholder Vote For His $24.9 Billion Bid To Privatize Dell Inc.

- Michael Dell Looks Ready To Cross The Finish Line On September 12th With Bid To Privatize Dell Inc

- Michael Dell’s $24.8 Billion Offer To Privatize Dell Inc Finally Goes To Shareholder Vote On September 12th

- After Delaware Legal Ruling Icahn Throws In The Towel In Dell Fight

- Behind The Scenes Maneuvers Continue As Carl Icahn Tries To Outlast Michael Dell

- Dell Inc. Cuts Revised Deal with Founder Michael Dell and Silver Lake Partners

- To Vote or Not to Vote That is Certainly The Question for Dell Shareholders Unless the Company Postpones The Vote One More Time

- Requiem Or Prologue For Dell ? Shareholders Prepare To Vote

- Dell : The Dramatic Shareholders Meeting May Be Delayed For The Second Time

- Dell Deal Delayed

- It’s Getting Messy At Dell As Carl Icahn Takes The Battle Down To The Final Whistle

- Endgame Arrives For Dell’s Buy Out Bid: As Usual The Arbs Hold The Cards

- Endgame Arrives For Dell’s Buy Out Bid: As Usual The Arbs Hold The Cards

- Carl Icahn attacks the Dell takeover struggle, but from a different angle

- Carl Icahn Reportedly Building A $7 Billion War Chest To Finance His Dell Bid

- Carl Icahn attacks the Dell takeover struggle, but from a different angle

- Dell Deal With Michael Dell Goes Live Shareholders To Vote In July

- The Dell Deal Suddenly Looking Less Attractive

- Both Michael Dell And Fidelity Want To Know What Makes Rami Run?

- Situation At Dell Becomes More Interesting As The Blackstone Group Pull Out Of The Bidding

- Who is Rami Levy and why investors love him

- Both Michael Dell And Fidelity Want To Know What Makes Rami Run?

- Carl Icahn Cuts Dell Some Slack As He Agrees To An Investment Cap

- Carl Icahn Continues To Make Waves- But This Time Its Sound Waves

- Update: It Just Got More Crowded At Dell As Stephen Schwarzman’s Blackstone Joins Carl Icahn In A Bidding War.

- Icahn Set To Put A Spoke In The Wheel Of Michael Dell’s Dream Buyout

–