–

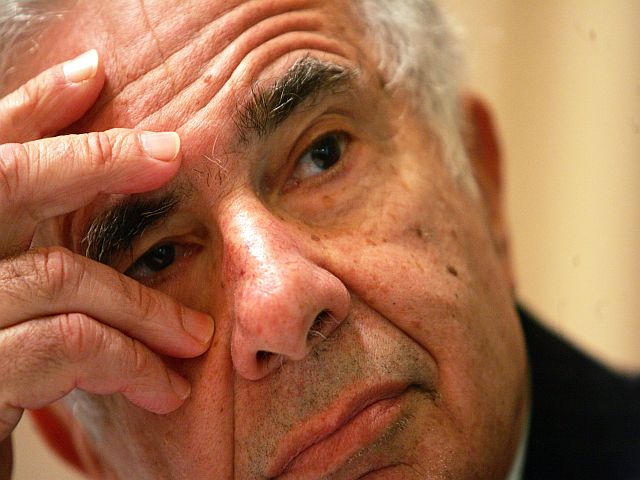

There would be little argument that the name Carl Icahn strikes fear in a large number of CEOs in corporate America. Over the years Icahn has developed a reputation for identifying companies that are underachieving and, through taking a stake in them has seen them reorganize and increase their profitability .

–

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

–

/ By Yoel Bermant /

With his involvement in the attempted multibillion-dollar buyout battle for computer maker Dell Inc, that ll while at the same time getting on the side of Herbalife , you would have thought that Icahn would have had more than enough on his plate.

However they don’t call Carl Icahn the “ king of intervenist stock speculation” , for nothing. It is due to the uncanny knack he has developed of discovering companies that may be undervalued or resting on their laurels. And no matter what, as soon as Carl Icahn shows any form of interest in these companies and especially when he makes a share investment, those following the stock market are inclined to jump in, usually behind him, and in most cases pushing the company into re- organization and increased profitability.

Icahn has now discovered another under-achieving gem obviously worthy of a shakeup. Nuance is the company currently under the Icahn microscope. A computer software company Nuance are the market leaders in speech recognition technology. Although there are no official disclosures on the subject, reported to be heavily involved with Apple in the development of their Siri application, which is the emerging voice-based service for users of the iconic iPhone.

For some time there have been rumors on the Street that Apple are considering swallowing up Nuance. Rumors which are obviously strong enough to induce private equity group Warburg Pincus, to take a 16.8% share in the company. Warbug Pincus , owned by the fabulous wealthy Warbug family , is obvious no slouches picking up the shareholding after Nuance stock dropped by a quarter in February after cutting their full-year financial targets.

Carl Icahn obviously intends to take a leaf out of the Warburg Pincus book and has reportedly purchased 9.3% of the Nuance stock, at their current market value of around twenty dollars a share. The “Icahn effect “ was immediately sufficient to push up share values up by 5.70 percent in one day, and they are currently valued at Tuesday to close at $21.33, pushing the overall value of the company up to at $6.75 billion. Icahn’s stock share is now valued at $625 million, meaning that he made a comfortable profit of around thirty million on the day.

HoweveR, as Carl Icahn is well aware, there is still a long way to go before shares in Nuance return to the level of thirty dollars a unit where they sat as recently as September of 2012.

However according to rumors on the market, Carl Icahn is liable to face a tough battle to make any significant changes in Burlington-based Nuance management policy against the company’s famously strong willed chief executive Paul Ricci who has pushed Nuance to the forefront in speech technology, largely as a result of the towns of the in-house development staff but no less than through a several shrewd acquisitions, by following a policy of swallowing Startup competition before they can make any impact on Nuance’s market share.

Those expecting tough boardroom battles may be disappointed, because, as usual, Icahn is being particularly low key in his involvement in Nuance, Those close to the inveterate corporate intervener speculate that Icahn, at least initially, will take a passive position in Nuance with no intentions to move for a change in company strategy or even boardroom representation.