–

–

/By Clive Minchom /

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

Bidding for Dell Inc. has seemed lately to be going in favour of the privatization bid by Michael Dell and Silver Lake Partners, at US$13.75 a share plus a special dividend of another US$8 cents a share.

The other day, too, Michael Dell’s bid indirectly got another boost as Dell released its quarterly earnings, which showed a large decline in net income of 72% on basically flat sales. For anyone who had still thought his takeover bid was too cheap this news came as a firm corrective.

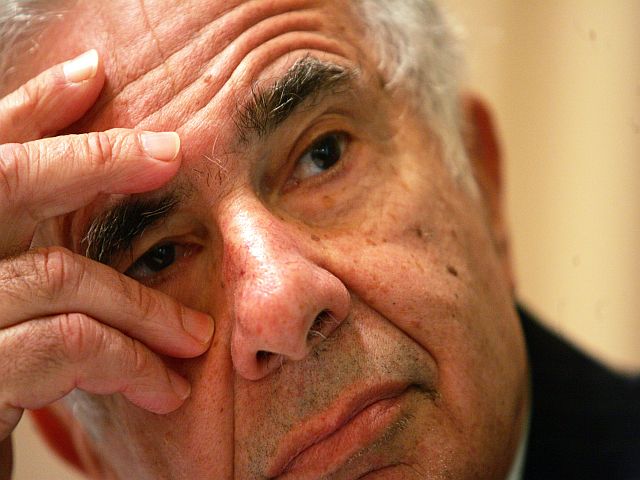

Carl Icahn, who had earlier put up a, competing, company partial re-leveraging plan as an alternative had still been pursuing his goals in the courts though, trying to block using legal means what he has so far been unable to do with enough cold, hard cash.

However yesterday a judge derailed this plan as well in the Court of Chancery in the State of Delaware where he had gone to try and block the deal. Chancellor Leo Strine of the Delaware Court of Chancery basically rebuked him, saying that the Special Committe of the Board of Dell had acted properly and in the interests of all shareholders throughout the last several months, and had also acted correctly in accepting the bid from Michael Dell and Silver Lake Partners. He also stated that the Committee had acted appropriately both in updating the appropriate record date to qualify to vote for the transaction, and in changing the rules for conducting the shareholder vote from a pure “majority of the minority” to simply a “majority of independent votes cast”. Finally the judge saw nothing wrong in Dell re-scheduling its annual general meeting until October 17th, a month after the September date now scheduled for the vote on the Michael Dell proposal itself.

The ruling by the judge now means that on September 12th, 2013 shareholders of Dell Inc. should now finally get to vote on Michael Dell’s privatization proposal, unless other bidders should emerge with a better offer in the meantime – and which the Judge pointed out was an option also still available to Carl Icahn too if he wished to do so.

In speaking to the press after the judgement Carl Icahn now appears to be throwing in the towel…“I believe I made a competing bid that was superior. I am obviously disappointed that the judge didn’t see it that way, ” Mr. Icahn said. “But we did get $350 million more from Michael Dell for shareholders. We did the work the board should have done.”

Now Carl Icahn has a shiny new toy in his recently disclosed Apple investment to play with, and one which is perhaps more likely to make him a ton of money than running after Dell anyway, having perhaps bought in to Apple quite cheap in relation to its prospects looking forward. Shareholder activism is all very well, but buying a good business at what looks to be a psychologically correct moment of inflection, after investor sentiment had been absurdly negative for far too long for no very good reason, as in the Apple case, may actually make him a lot more.