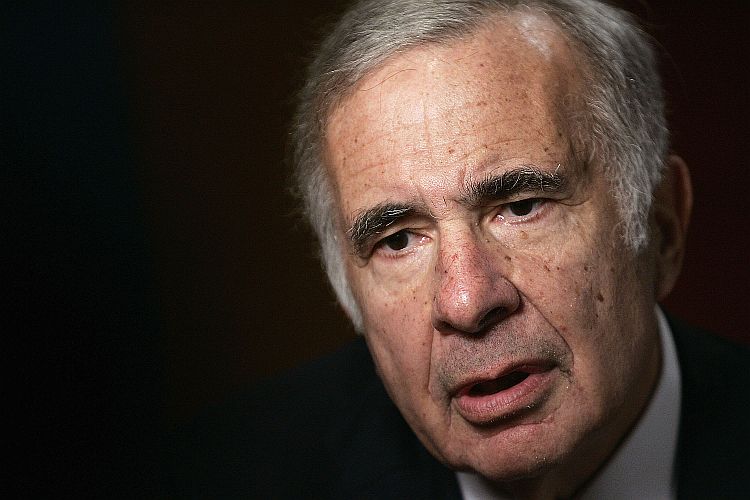

Icahn, one of the world’s most dynamic and intrepid activist investors, is reportedly taking his leveraged recapitalization proposal for Dell computers a stage forward through initiating a series of meetings with banks and asset managers to put together a financial package that could reach as high as $7 billion in bridging loans.

–

/ By Yoel Bermant /

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

Icahn along with his partners Southeastern Asset Management Inc are reportedly working flat out to make sure that they have the necessary finance in place well before the forthcoming Dell shareholders meeting to be held in July. At that meeting Dell shareholders will be expected to trade between the initial take-private offer from CEO Michael Dell along with his Silver Lake Partners against that of Icahn and Southeastern. According to industry sources, retaining the status quo is also another option.

In the meantime Icahn and Southeastern are reported to be in the market for financing at a level between five to seven billion dollars, with global merchant banking operation Jefferies already understood to have committed $1.6 billion in bridging finance. According to reliable sources, Icahn is confident that he will have the remaining finance in place well before the shareholders meeting in July.

What is more than likely giving Icahn confidence is the fact that any financial institutions who commit themselves to providing bridging finance are, in any event, guaranteed a fee payable in advance of 3.5 percent, which is typical of these transactions. Unofficial reports also have it that Icahn and Southeastern are making the proposition of lending them money to finance the Dell takeover even more attractive through offering potential lenders an additional 7.5 percent premium that will be offset set against incremental profit in the event that they Icahn/ Silver Lake offer is accepted. In the event that the Icahn and Southeastern offer is accepted by the Dell’s shareholders, any bridging loans issued will revert to permanent financing.

The financing drive comes as a follow-up to a letter sent to the Dell’s board on May the ninth in which Icahn and Southeastern Asset Management, made an official proposal to better founder Michael Dell and private equity firm Silver Lake Partners original offer. Under the Icahn proposal, shareholders would be entitled to hold onto existing stock, while enjoying the option of being the recipients of either a distribution of $12 per share in cash or $12 per share according to stock value written down to just $1.65 per share.

Meanwhile Michael Dell and Silver Lake Partners, who are looking to take the company private for $13.65 per share valuing the company at $24.4 billion, are sitting pretty having already received commitments of $13.75 billion in bridging finance, from such leading banks as a number of banks, including Bank of America, Barclays, Credit Suisse, Merrill Lynch and RBC Capital. In addition Microsoft Corporation, one of Dell’s largest suppliers, has made a commitment to purchase up to $2 billion in subordinated notes.

From the offset Icahn and Southeastern who now hold around 13 percent of Dell stock, have argued that the Dell/Silver Lake offer undervalues the company.

However due to disappointing last quarter results shares in the company have slumped in value, with the most recent valuation being around $13.37.