–

Kravis’s KKR is spreading their footprint in the Far East, picking up ten percent of the shares in Chinese domestic appliance manufacturer Qingdao Haier

–

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

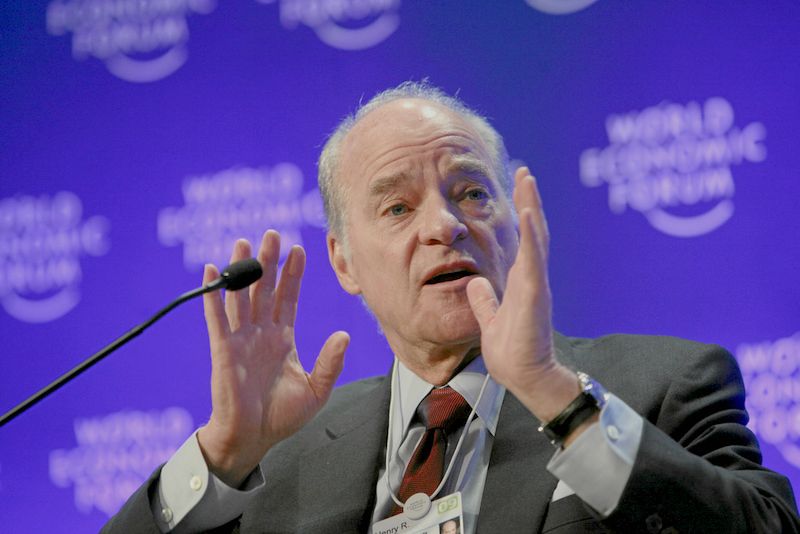

Henry Kravis / Getty

–

KKR, the New York-based private-equity firm, have made their largest investment to date in China, buying 300 million shares in Qingdao Haier, at a discounted price, 15 percent below the Shanghai Stock exchange value price set on the twelfth of September, the day before China’s largest appliance maker suspended their share trading, pending an announcing the share sale..

Henry Kravis and his partners at KKR are investing heavily in Asia, both for the international market as well as to take advantage of the rapidly developing domestic market. With average Chinese family becoming more aware of the pleasures of materialism, demands for domestic products are liable to increase considerably, and KKR’s investment in Qingdao Haier is adequate proof that the company is prepared to invest in order to reap the benefits of the vast potential expected over the coming years.

Turnover at Qingdao Haier, the Shanghai-listed division of the Haier Group, China’s largest appliance maker has increased by more than 25 percent each year since The Haier Group recently acquired New Zealand based Fisher & Paykel Appliances with a view to expanding their overseas market penetration as well as to take advantage of Fisher & Paykel Appliances manufacturing facilities spread around the world.

The Qingdao Haier acquisition comes hot on the heels of KKR’S buying up South Korea’s Panasonic Corporation for around $1.7 billion, while a few days previously, the Success Dairy, a company in which KKR has a major interest has reached an agreement to build dairy farms in cooperation with China’s Modern Dairy Holdings, the nation’s largest processor of milk and dairy products.

In the early part of the year, KKR increased their share in the Masan Group Corp, a leading Vietnamese based food-sauce maker. Their increased investment in Masan now stands at $359 million, making it the largest investment so far in the South East Asia region.

With KKR now operating six offices in Asia, in Beijing, Hong Kong, Singapore, Seoul, Tokyo, Mumbai as well as in Sydney, Australia, it looks the company will continue to expand their footprint in the Far East.

See more stories on KKR and Henry Kravis:

- Henry Kravis Continues His Health Drive – Paying Out $1.67 Billion To Acquire Panasonic’s Health Care Unit

- Gerald Parsky Sells Mitchell International Inc To KKR For $1.1 Billion

- Relationship Science Issues US$30 Million of New Equity

- Private Equity Giants Ponder Bid For Singapore Telecom’s Australian Unit Optus Satellite

- Israeli Off Road Tiyre Maker “Alliance” Sold To KKR For $500 million

- Henry Kravis’s KKR Buy Out Of Gardner Denver Raises A Few Eyebrows