–

–

At the beginning of February we learned that rugged-sports video/stills camera maker GoPro had filed documents with the SEC for an initial public offering. As its revenues were under US$1 billion at the time, the company kept the details of the filing confidential.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

Now the prospectus has been approved by the SEC and the IPO is underway, and of course its details are now made public for the first time – including the fact that it already achieved revenues of just under US$986 million in its fiscal year to December 31st, 2013. This was just below the US$1 billion threshold which, under the 2012 JOBS Act, allowed them to claim confidentiality for the filing.

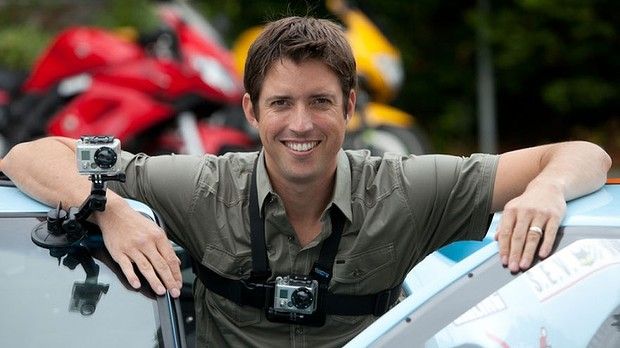

Read more about Nick Woodman :

The prospectus also indicates GoPro hopes to raise a minimum of US$100 million from the offering, which is likely to be hugely successful as it is now revealed to already be a very profitable company: in 2013 GoPro recorded net income of US$61 million.

After launching its first high definition product nearly five years ago, in July 2009, GoPro has sold 8.5 million of its HERO cameras, with 45% of these being sold in the last year alone as their concept of personal, mountable, rugged, take anywhere action video cameras has taken off.

GoPro products are popular in part because of the attention that has been placed on simplifying their subsequent digital work flow as well, which can be a disincentive for other video systems, making them more accessible to their users.

GoPro early on took the trouble to develop its own software, GoPro Studio, which enables its customers to quickly edit either simple or complex videos, and even create videos from time-lapse photo sequences. As at March 31, 2014, the prospectus indicates there had been more than 4.3 million downloads of GoPro Studio.

To get to this point GoPro has to date received substantial venture funding from top ranking VC firms such as US Venture Partners, Riverwood Capital, Sageview Capital, Steamboat Ventures and Walden Partners.

Taiwan tech manufacturer Hon Hai Precision, a.k.a. Foxconn, also invested in the company in 2012, at a valuation that was placed on the company then of around US$2.25 billion. This transaction reportedly made the company’s founder Nicholas Woodman a billionaire on paper for the first time, and the prospectus reveals he and his family still own just under 49% of the company’s shares.

Out in the wild, GoPro video gear has become just about ubiquitous these days for many amateur and major professional sporting activities and, as well, for parts of the action scenes in lots of motion pictures as well.

While GoPro is today clearly a hardware company it also claims to be positioning itself in the future as a media company. In the prospectus the company says, for example, “We are investing to scale GoPro as a media entity, ” though presently it does not makes any money that way.

GoPro’s media initiatives include its popular YouTube channel where thousands of amateur video clips are posted, some of which are very popular. GoPro also regularly commissions a number of professional videos made with its cameras in order to to promote the experience to its wider target audiences.

The GoPro Network now even includes a channel on Virgin America’s in-flight entertainment system. Essentially an endless loop of some of the best GoPro videos, is popular for bored passengers to watch, sometimes repeatedly. GoPro even gives all the content to Virgin for free at the moment.

The company has also announced its own Xbox channel, something that could also eventually bring some monetization through advertising and the option to buy GoPro products, and with a cut offered to Microsoft along the way. Nevertheless these initiatives all primarily exist to encourage people to buy the hardware, just as iTunes really started simply to drive sales of Apple’s hardware as well.

Accordingly GoPro indicates “We expect to continue to derive the substantial majority of our revenue from sales of cameras and accessories for the foreseeable future.” Nevertheless one never knows, as iTunes later itself become increasingly a substantial revenue driver for Apple.

Pricing and other details for the new initial public offering have not yet been set, but will almost certainly see another step up from the 2012 Foxconn transaction. Even after the dilution of a new offering the Woodward family will still maintain control of the company due to a dual class of voting share structure.

The company became a strong cash producer in 2013, generating over US$102 million from operations. Accordingly it ended up with US$111 million in cash sitting in the bank at March 31st, 2014. Total outstanding current and long term debt as of the same date was actually about the same amount, also at US$111 million. Thus GoPro’s net debt is therefore about zero at that date. The corporate loans in its balance sheet had been raised originally to fund substantial distributions to shareholders along the way.

The new offering under the IPO is expected to be for a minimum of US$100 million. This will include providing liquidity for existing shareholders as well as new money that will go into the company’s treasury. Depending of course on the final size of the offering, and the split between new money raised and money directed towards selling shareholders, that portion of the proceeds from the new offering that goes to the company is stated to be intended to be used to repay term debt and for “general corporate purposes.”

JPMorgan, Citigroup and Barclays are the lead underwriters for the proposed share offering.