–

Facebook Joins S&P 500

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

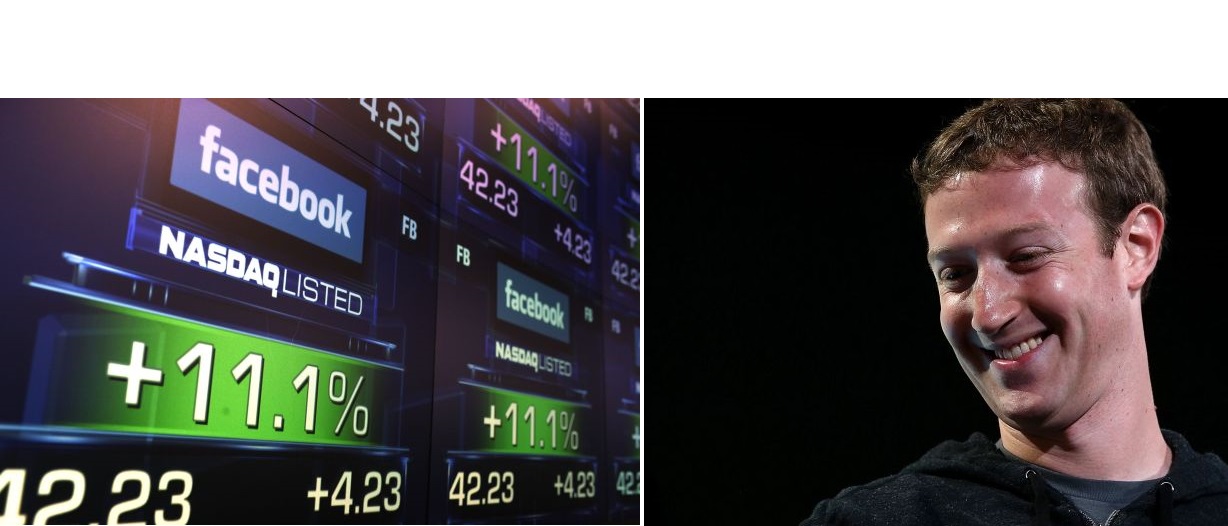

Facebook has been in the news quite a bit this week. First, Standard & Poor‘s (S&P), a division of McGraw-Hill Financial has announced that, effective as of the close of trading on December 20, 2013, it plans to include Facebook’s Class A common stock in the S&P 500 Index, which is comprised of 500 common stocks that S&P selects as representative of various segments of the American economy.

That is a significant step for the company as it means that a lot of Index Funds, who buy only shares that are components of the various indices they track, will now automatically add some of Facebook’s stock to their portfolios, and by some one should infer quite a lot actually.

Anticipating this development, and to help meet the demand from the Index Funds without temporarily driving its shares through the roof, this morning Facebook announced that it and some of its insider holders, including Mark Zuckerberg himself, are now offering some shares to the public.

Facebook Selling About US$3.9 Billion Of Shares

Facebook is therefore commencing an underwritten, registered, public offering of 70 million shares of its Class A common shares. At a recent price of about US$55 per share, that would provide total proceeds of US$3.9 billion, gross, i.e. before deducting underwriters fees and the costs and expenses of the offering.

The usual crowd of suspects, J.P. Morgan, BofA Merrill Lynch, Morgan Stanley and Barclays are serving as lead underwriters for the offering.

Just over 27 million shares of the total are being offered by Facebook itself, as new shares from treasury, and a total of just under 43 million shares are being offered by certain selling stockholders as a secondary offering, including 41, 350, 000 shares offered by the company’s founder Mark Zuckerberg.

Of course Facebook will not receive any proceeds from the sale of shares by the selling stockholders. However, at the recent price of about US$55 per share the company should still receive about US$1.48 billion, gross, from the offering i.e. before deducting underwriters fees and costs and expenses of the offering. It might use some of the money for acquisitions, or for general corporate purposes according to the prospectus.

Mark Zuckerberg Selling Some Shares To Pay Income Tax On Option Exercise

Mark Zuckerberg should personally receive about US$2.27 billion, gross, from his planned sale of shares. Facebook has indicated, however, that the majority of the net proceeds he will receive are expected to be used to pay income taxes which he will owe after exercising in full an outstanding stock option to purchase 60, 000, 000 shares of the company’s Class B common stock, which are convertible into Class A shares but carry ten votes per share until they are, as do most of his existing holdings. Thus he will still control just over 56% of the voting power in the company even after the offering is completed, or 62.8% including certain additional shares over which he holds voting rights.

That is the way the corporate options game works; when you exercise options at an option price that was set sometimes long ago, and that is now below the current market price, you have to pay tax on the difference even if you want to keep the shares. For corporate executives that usually means selling some of them just to find the money to pay the income tax. So both Mark Zuckerberg and Uncle Sam win when that happens, as it is here.

It seems that after the dust settles Mr. Zuckerberg will therefore “only” get to keep about US$33 million out of his share of the net proceeds, which he can use for sprucing up his garden at home perhaps, or even maybe to help pay for some of his neighbours’ properties that he has been buying up lately, in order to secure his privacy.

He will still have plenty of shares left though, worth billions. At the recent price of US$55 the company will have a post offering market capitalization of about US$135 billion and is trading at the astronomical P/E ratio of 139 times trailing twelve months earnings. At that price Mark Zuckerberg’s own personal holding will be worth somewhere around US$24 billion.

A year ago he gave away another 18 million of his Facebook shares, worth some US$500 million at the time, to the Silicon Valley Community Foundation which administers his charitable giving. Now he has also committed to giving away another 18 million shares to the same foundation, but this time the new gift is worth twice as much, at almost a cool US$1 billion as the shares have gone up so much in between. So selfishness is certainly the last thing one would ever want to accuse him of.

Judge Gives Claimants Standing To Sue Facebook Over 2012 IPO

Ironically, just as the shares of Facebook have been booming of late, the courts have been catching up on a shareholder lawsuit, one arising out of the company’s original IPO early in 2012. The shares offered by the company under the IPO were sold then at US$38 per share, but fell by about 50% shortly afterwards when there was a nasty scare that Facebook might not do very well in the “switch to mobile”. This is something that is going down big in the tech world these days, and is a trend that can have major implications potentially for the way advertisers place their business.

It seems Facebook had alerted their underwriters about such trends prior to the IPO launch, and presented some projections to them about their possible implications for Facebook, but then did not actually disclose these specifically to its potential investors in the prospectus for the offering itself.

Once the whole issue ultimately became live later in the press, the shares immediately tanked leaving many investors hugely underwater for a considerable period. In response some very angry shareholders have sued in court, and just yesterday US District Judge Robert Sweet said in a court in Manhattan that investors did indeed have the right to at least pursue the company legally over their claim.

Facebook’s own lawyers had argued the suit was without merit as the projections were in any case immaterial. The judge clearly thought otherwise, and this suit will now move forward – slowly of course as the wheels of justice can grind at a glacial pace.

One might think that at the end of the day this suit may end up not going very far as, after a lot of hand wringing by anxious analysts, Facebook has lately looked like it now has quite a good plan for mobile, and indeed has already been increasing its mobile revenues handily in recent quarters. Hence the jump in the shares, basically almost tripling from their low last year, and now up by almost 50% even on the original IPO price. But one never knows.

–