–

In our last post, we talked about why people invest and gave you some ideas about the shortcomings of traditional thinking in the investment world. Today, we will talk about how we use the concepts of risk and return.

Let’s start with a familiar scenario. Fed up with the paltry interest payments on your bank account, you have put your foot down and decided to brave the waters of the world of investment. You’ve started talking to friends, family, and professionals about where you should put those hard-earned dollars.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

–

Dar Sandler Davide De Micco

–

Your coworker Frank tells you that he financed his vacation in Europe by playing the market with Google and Tesla stock, and strongly advises you to do the same. Joe at the barber shop, who has never stepped foot outside the country, says that Emerging Market bonds are “basically inflation-proof” and are blowing U.S. bonds out of the water. He especially likes his Indonesian Bonds, although he often confuses the country with India and is “less than convinced” that they are really two separate countries.

Finally you meet with Samantha, who has opened a foreign currency trading account and is making thousands of dollars a week speculating on the euro versus the dollar. “It’s really easy, you should try it, ” she says.

Drowning in a sea of advice, you try to make sense of all these recommendations. How should you evaluate stocks versus bonds? For that matter, how should you evaluate any asset?

We will start by focusing on long-term investing. This is sometimes referred to as “buy and hold” or “passive” investing. You are locking your money into some kind of an asset or security, with the expectation that it will appreciate over time. Why does it appreciate? Because you, like any other investor, want to be compensated for keeping your money in that investment, rather than someplace else. Money that is sitting in Company X stock is money that you can’t be using to pay bills, or take that long-awaited ski trip!

If you buy stocks, you are expecting those stocks to gain value, and in many cases you hope to collect dividends from them as well. If you buy bonds, you are expecting to collect regular coupon (interest) payments, and then receive your initial investment (principal) back when the bond matures. Unfortunately, expectations and reality do not always coincide. This brings us to risk, the other side of the coin. Ultimately risk is just the probability that you will not receive the return you expect. That’s it, really.

Risk can exist in many different forms. There’s repayment risk, the risk that one of the third world countries on Joe’s A-list will decide that it would rather spend export revenues on a new fleet of Mercedes sedans than fulfill its debt obligations.

Interest rate risk describes situations where rising interest rates reduce the value of a bond that you are holding. Inflation risk is exactly what you would expect – higher than expected inflation reduces the purchasing power of the returns you are receiving from your investments. These are only a few examples from many others. We call all of these types of risks “factors”, a term that you will continue to see in future articles.

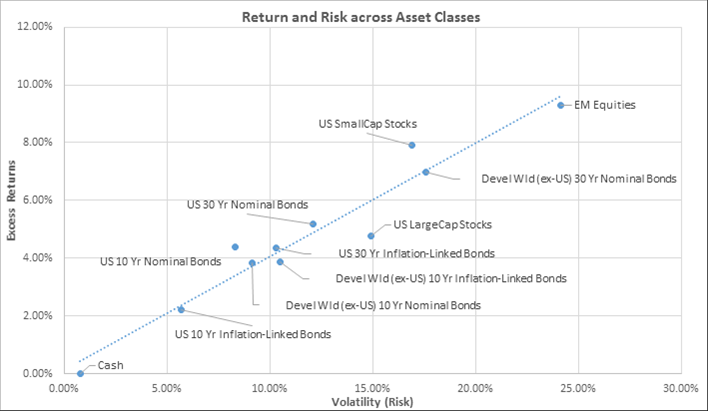

Over the long term, the return you receive is driven by all the different risks that you are being ‘compensated’ for accepting. This linkage between higher risk and higher returns is ruthlessly enforced by the market. We can say that the total ‘risk-premiums’ of a stock, bond, or commodity, you name it, will be kept aligned with the latest information through the actions of buyers and sellers in the market. The picture below shows this in a clear way:

–

*Based on Bloomberg data. EM = Emerging Markets.

–

So now you understand that riskier assets should deliver higher returns in the long term. But which stocks and bonds should you buy?

The best answer is simple: not any individual stock. When you buy a wide array of securities in an asset class (for example, all the companies in the S&P500), the only risk you are taking is the general risk of the market. You will make and lose money to the extent that the market rises and falls. As John F. Kennedy once said, “a rising tide lifts all boats.”

When you buy stock from just one company, you add the specific risk of that one company onto your overall market risk. A key principle of investing is that you will not be compensated for specific risk. If that one stock you choose does well in the short-term, you may reap the benefits.

In the long-term, the market understands that you can diversify your risk away, so you will not be compensated for potential losses from a specific stock. To re-emphasize, putting all your money in one stock, the proverbial “all of your eggs in one basket”, is an entirely avoidable risk for which you will not be “made whole”. Don’t worry if this does not make perfect sense now, we will spend more time on future articles talking about why stock picking is a bad idea.

What about short-term investments? Let’s revisit your ‘mentors’ from earlier. Samantha’s daily trading in different currencies, or Frank’s buying Tesla and Google stocks and quickly flipping them for a profit, are both examples of “alpha-investments”. In alpha (active) investments, the investor (or speculator) thinks he or she knows better than the market and can ‘beat’ it. This is to be sharply distinguished from what we discussed for the bulk of this article: the long-term collection of risk-premiums, also known as beta (passive) investments.

The most important question to ask is: “Should you expect a better return on alpha investments compared to beta investments”? The short answer is – “NO”. Alpha investing, like poker, is a zero-sum game. Nobody makes money without somebody else losing money. From this perspective, it is not too different from gambling. The key distinction is that most people will have more fun playing cards or throwing dice in a casino than trading stocks at home (and maybe getting a few free drinks along the way).

As you can see, risk and return walk hand in hand. Look for future articles in which we will continue to refine this idea and go into more detail about different kinds of risk. We will also show you how investors seek returns by selecting and taking advantage of associated risk-premiums. Until then, don’t let your fun at the blackjack table affect your investing strategy!

Edited by: Simon Cartoon