–

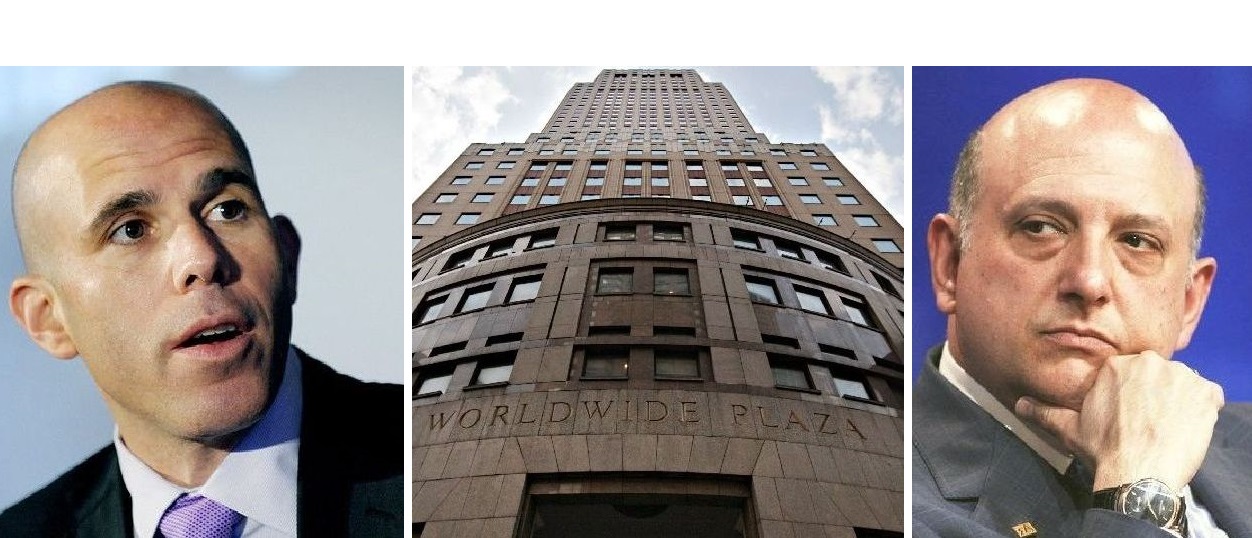

Twelve days ago Jewish Business News reported that Scott Rechler’s RXR Realty had gone to court to try to prevent the sale of 1 World Wide Plaza, a 59 storey 1.2 million square foot office complex in mid-town Manhattan to a competitor, American Realty Capital (ARC). RXR claimed its own bid had basically been blocked by the seller George Comfort & Co, and that the announced winning purchaser had breached confidentiality arrangements earlier entered into with RXR for consideration of a joint venture bid to purchase the building together.

It seems the Judge in the case took RXR’s claim seriously enough to temporarily block the closing of the sale transaction while she considered the case; this was announced on October 28th.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

Scott Rechler’s RXR Realty 1 World Wide Plaza New York Nick Schorsch’s ARC

–

As a result of the court’s decision, the building’s existing owners, a partnership between George Comfort & Sons, DRA Advisors, RCG Longview and Ramius Capital, then agreed to put the planned sale to American Realty on hold at least until Wednesday November 6th. That is when the State Supreme Court could have decided whether a further holding period would be necessary to decide the case.

Finally, however, just two days after imposing the temporary pause of the sale, the Judge in the original hearing on October 30th then herself finally dismissed RXR’s claims, and allowed the sale to American Realty to proceed, nixing Scott Rechler’s hopes of buying the building.

Thus after the close of business on October 31st, American Realty closed on the purchase of an initial 48.9% of the property, with a continuing option to buy the rest, all at a total valuation of US$1.45 billion according to Crain’s New York. This is also apparently a price US$100 million more than RXR’s bid in any case.

Crain’s also reports that Judge Shirley Werner Kornreich, of State Supreme Court, said that George Comfort & Sons and the other sellers had a right to terminate the deal with RXR, when after months of trying without success to close the deal, RXR asked for an extension.

“I believe that the plaintiff here was in default, was unable to go forward with its agreement, it could not get the consent of the lenders which it needed in order for the contract to go forward, there were issues in regard to the investors” Judge Kornreich said according to a transcript of the court hearing on Thursday.

It seems American Realty Capital agreed not only to pay more for the 59-story tower, but also were willing to waive receipt of lender consents as well. Thus they must be very confident in the strength of their own covenant and ability to re-finance the building in the, probably unlikely, event the lenders should later balk.

“In the end we got a better deal, ” said Martin Luskin, an attorney with the law firm Blank Rome, who represented the sellers in the suit and is quoted by Crain’s. “One of the things that was frustrating for the sellers was that we had no certainty of closing. But with American Realty Capital, we got a deal that was structured in a way that would allow us to close.”

This is definitely a big fish that got away for Scott Rechler, and American Realty are the beneficiaries with a very solid looking acquisition. Still Scott Rechler is unlikely to be down on the mat for very long and will be back in the game very soon.

About American Realty Capital

American Realty Capital is chaired by its co-founder Nicholas Schorsch and is a major US commercial real estate investor. The company operates through a group of five publicly registered, non-traded, real estate investment trusts.

These include i) American Realty Capital Healthcare Trust, which will invest in income-producing healthcare facilities located throughout the United States; ii) American Realty Capital New York Recovery REIT, an offering that acquires institutional quality office and retail properties in New York City; iii) American Realty Capital-Retail Centers of America, an offering that will focus on the acquisition of lifestyle centers, power centers and large needs-based shopping centers; iv) American Realty Capital Trust III, which acquires freestanding, single-tenant properties, net leased long-term to investment-grade and other creditworthy tenants; and v) Phillips Edison-ARC Shopping Center REIT, which invests in grocery anchored shopping centers.

–