–

–

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

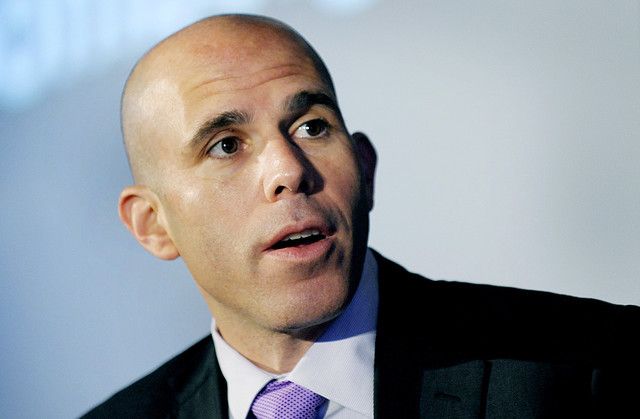

Scott Rechler is clearly not a person to be trifled with. He sold his New York based REIT for US$6 billion in 2007, just a few months before the crash that came with the onset of business recession and the financial crisis that started in earnest in 2008 with the bankruptcy of Lehman Brothers.

However he has since parlayed the liquidity that came with the sale to become one of the big winners of the real estate realignments that subsequently occurred in New York in the period since, and in the last two years in particular has aggressively bid for a number of trophy properties that came up for sale, winning his fair share.

Along the way there has been tough competition from other liquid buyers of course who are in the the same game, some of it not always pleasant or, perhaps completely ethical at times maybe either.

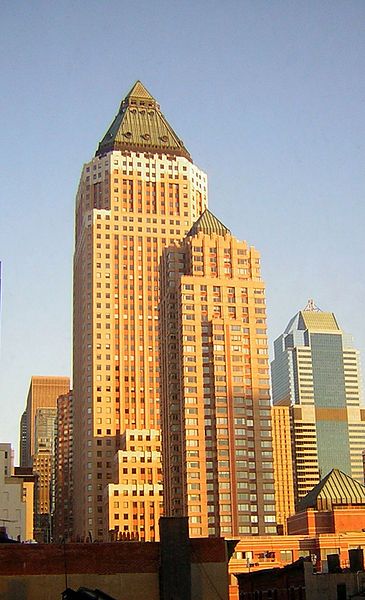

In a very good current example possibly of the latter, last week Scott Rechler’s RXR Realty LLC (RXR) filed suit against George Comfort & Sons (George Comfort) in the New York State Supreme Court in Manhattan. The suit alleges George Comfort failed to honour a deal to sell to RXR an important commercial office and retail building, World Wide Plaza located at 825 Eighth Avenue in Manhattan. The complex was built originally in 1989 and was developed originally by William Zeckendorf Jr.

George Comfort controls the partnership that owns the building, acting through two limited liability partnership vehicles known, not surprisingly, as “WWP Sponsor LLC” and “WWP Holdings LLC”. An LLC, or limited liability company, is the hybrid corporate/partnership entity that everybody loves for real estate deals as it combines the tax benefits of a partnership with the liability limitation provided by corporate ownership.

Worldwide Plaza New York

–

Also named in the suit is a company called American Realty Capital Properties (ARC) who it seems eventually ended up with the deal by paying more money and, allegedly, by having fraudulently piggy-backed on RXR’s own due diligence in direct violation of confidentiality agreements.

According to the suit, in May of this year RXR signed an agreement to buy a 48.9% interest in the ownership of Worldwide Plaza, valued at US$1.25 billion. RXR agreed to pay about $660 million for the interest, apparently more than its owners had paid for the entire office tower in 2009. RXR also obtained the right to buy the remainder of the building as well, at a slightly higher total valuation of US$1.35 billion.

To secure the deal RXR put up a deposit of US$25 million in escrow. The Agreement was also conditioned, as is usual, on the parties’ obtaining the consent of the building’s existing lender, through its master servicer and special servicer, and provided for extensions of the closing date to accommodate the lender approval process, as institutional lenders are known to rarely move at the speed of light.

According to the suit George Comfort then “sabotaged the lender approval process in order to coerce a termination of the agreement” with RXR and in parallel secured better terms from another buyer, ARC.

As recompense RXR are seeking both reinstatement of their agreement and substantial damages, or as the dry language of the lawsuit precisely puts it… “(1) reinstatement and specific performance of the Agreement; (2) money damages of $200 million; (3) prejudgment and post-judgment interest; (4) attorneys’ fees incurred in this action; (5) the disbursements, costs, and expenses of this action, and (6) such other and further relief as the Court deems just and proper.”

As is customary in such transactions, there was a lot of information exchanged between the parties as part of RXR’s due diligence process, and for the purpose of finalizing details of the package of appropriate financing for the deal, presumably both existing and new. In the quaint language of New York real-estate speak they call this the financing “stack” of a property – and it has nothing to do with chimneys, it is just money going up in smoke.

The suit claims that, as part of the process, George Comfort promised RXR an extension of the closing date, as long as the master servicer agreed to the deal, which is quite usual as these things do take time and both parties often have to give and take a bit on timing to get to the closing. “Master servicer” is the name given to a company which typically organizes the servicing of all the different tranches of a commercial property’s mortgage loans, or stack, and “special servicer” is an additional party involved sometimes for some loans, usually those which have previously entered into a default.

The suit alleges however that George Comfort was not acting in good faith and, specifically, deliberately… “fraudulently induced RXR by promising … an extension of the closing date provided that the master servicer granted its consent to the transaction and conveyed that consent to the special servicer by October 4, 2013 for its consideration.”

But when RXR finally satisfied the condition and got the required permission from the “master servicer” – George Comfort then simply reneged on its commitments and went ahead with its better deal with ARC which it had it seems been pursuing at the same time.

But the suit goes even further than this, in a rising cadenza of allegations which is impressive for a failry short two page document, claiming that ARC were only able to do the deal at all in the time available because ARC had misappropriated RXR’s own confidential and proprietary due diligence, structuring, and related analyses for the transaction. RXR had shared these with ARC pursuant to a separate written confidentiality agreement between them entered into on July 15, 2013 for a possible joint venture. If proven, that is bad faith indeed; now it is up to the Judge to sort things out.

–

Worldwide Plaza New York

–

Worldwide Plaza, is a 49-story tower on 8 Avenue between West 49th and West 50th streets. It has 1.8 million square feet of space. Mid-town Manhattan has been a steady beneficiary of emigrating Wall street firms looking for cheaper digs in the continuing fall out from the recession of the last five years, and two years ago Nomura Holdings Inc. agreed to move its offices to Worldwide Plaza from the World Financial Center downtown. This filled a large vacancy and increased the building’s cash flow, basically restoring the viability of the property and presumably its status with its lenders as well.

George Comfort bought the building in 2009 for just US$600 million from Deutsche Bank, who had seized it from New York Developer Harry Macklowe in 2008 when he defaulted on his loans. In turn Macklowe had bought it at the top of the market in February 2007 for US$1.74 billion – i.e. at around exactly the same time that Scott Rechler sold Reckson Associates, demonstrating that timing is indeed, if not everything then still quite a lot and a determining factor in many large fortunes.

If Rechler can win the case and close the deal this will be another trophy to add to his collection, in his buying spree that has been ongoing, and likely at a fair price too. He has already picked up over US$4 billion of properties in New York and is one of the largest real estate buyers to have emerged out of the ashes of the Lehman brothers melt-down that almost brought New York to its knees, and of course brought great angst to its real estate community at the same time.

“I imagine we will get bigger, ” Rechler told The Real Deal during an interview in his Long Island, headquarters a few months ago in May. “We have a lot of investment opportunities that we are pursuing right now. We have capital that we have been raising to invest. We think this is the time to be active. We believe we are still in the early stages of this market.”

This aggressive but firmly grounded attitude is typical of the guy, who grew up in a prominent New York real estate family but who has clearly made his own mark in the industry since.

Describing a potential foray into the Lower Manhattan financial district when he was one of the bidders for the Chase Manhattan Plaza, a 2.2 million square foot trophy building now being unloaded by JP Morgan Chase, he said just in September:

“Lower Manhattan is in an awkward stage, ” referring to opportunities for investment in the Financial District. “That’s an area we’re focusing on because when you get through that awkward phase it’s going to be an incredible place. If you have patience, it’s going to be incredibly successful.”

In the end he lost the bid for Chase Plaza to a Chinese investor billionaire Guo Guangchang but will surely continue to look at the area carefully.

About Scott Rechler

Scott Rechler, who is 46, grew up in Port Washington and Roslyn in a prominent Long Island real estate family. His grandfather had formed Reckson Associates in 1968, with Scott’s father and his uncle Roger, to build suburban office buildings in Long Island.

He took his undergraduate degree at Clark University in Worcester, Massachusetts where he was elected student body president. Subsequently he earned a Masters of Science degree in Real Estate at New York University’s Schack Institute.

Rechler then naturally enough gravitated into the family business, building up Reckson and finally taking it into a new sphere as a publicly traded REIT. As well, he took it far from its original suburban origins to become a major player in the Manhattan property market as well with the purchase of a Manhattan based REIT called Tower Realty in 1998.

Eventually, in 2003 he split with the family interests, who remained amicable but who preferred a quieter life, divvying up properties between them and Rechler continued to run Reckson Associates, and of course remained a major shareholder, until its sale in 2007 when he founded his privately held RXR.

Already RXR has built up a portfolio of US$6 billion of New York trophy properties, likely at some very good prices until the market recovered substantially this year, and some suburban New York properties as well, and the firm is already as big as the former public REIT Reckson Associates itself, that he sold with such impeccable timing in 2007.

With a non-competition agreement negotiated at the time with the buyer who acquired Reckson, SL Green, which prevented him from buying properties in the Manhattan market for one year, he was fortunate perhaps to sit out the worst of the downturn and then to be well placed with liquidity to move back in again on his own terms. But then winners do tend to make their own luck don’t they?

Scott Rechler is married with two children.

–