Icahn Enterprises, Carl Icahn’s firm, saw its shares plummet after it announced a 50% cutback on dividends. It also reported a second-quarter revenue decline of 27.5% year-on-year to $2.54 billion, missing the consensus of $2.66 billion. The firm’s shares fell almost 30% at one point during trading on Friday.

Many analysts attributed the drop in revenues to a report released in May by Hindenburg Research that charged Icahn Enterprises with running a Ponzi scheme. That firm alleged in its report, “In brief, Icahn has been using money taken in from new investors to pay out dividends to old investors. Such Ponzi-like economic structures are sustainable only to the extent that new money is willing to risk being the last one ‘holding the bag.’”

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

Carl Icahn, Chairman of IEP, said, “I believe the second quarter partially reflected the impact of short-selling on companies we control or invest in, which I attribute to the misleading and self-serving Hindenburg report concerning our company. It also reflected the size of the hedge book relative to our activist strategy.“

“Subsequent to the quarter, I have entered into a three-year term loan agreement with my personal lenders (see Form 8-K filed on July 10, 2023), which in my opinion, has significantly diffused the effects of the misleading Hindenburg report and focused on our activist strategy and reduced our hedge book.”

“While we made money on the long side through our activism efforts, our returns have been overwhelmed by our overly bearish view of the market and related oversized short (hedge) positions,” added Carl Icahn.

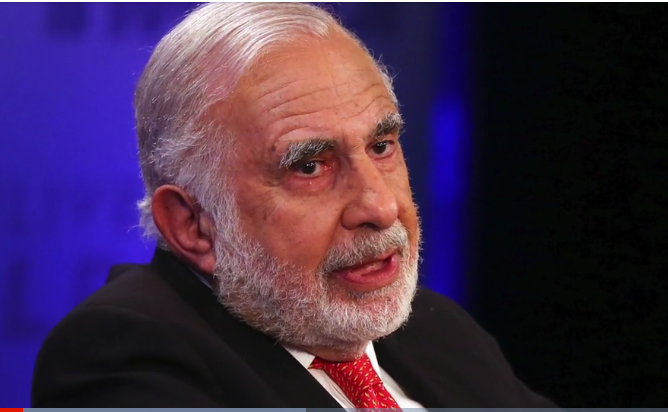

According to his official bio, Carl Icahn is a New York City native and grew up in Far Rockaway, Queens. After receiving a degree in philosophy from Princeton University in 1957, he attended medical school at New York University and then joined the Army.

In 1961 Carl Icahn began his career on Wall Street. He has gone on to become one of the most well-known and influential investors in America. In 1968, he formed Icahn & Co., a securities firm that focused on arbitrage and options trading. In 1978, he began taking very substantial and sometimes controlling positions in individual companies.