by Amir Weitmann, Co-Founder and Managing Partner at Champel Capital

Israel has a vibrant, startup venture capitalist ecosystem and is one of the top two countries in the Middle East with the highest growth expectations in 2022. Unique from other countries, many of the most innovative technologies developed in Israel were derived from the Israel Defense Forces (IDF).

The foundation of the country breeds successful businesses and businesspeople, and with an abundance of startup companies and funding. Israel has developed innovative technologies for many years and in fact, had a head start over other countries due to early on-the-job training and a focus on education and entrepreneurship.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

Israel VC Investment Outlook

In 2021, the amount of capital raised in Israel hit an all-time high at $26billion, a shattering 8X jump from the amount raised in 2015. Markets notwithstanding, $9.8 Billion were invested in H1 2022, almost as much as the entire 2020, which by then was a record year. Almost all major global tech companies have R&D centers in Israel, and the modernization of the country has seen the fastest transformation in history. Notably, 2020 was a key year for increased institutional investment into the country’s robust tech industry, which is a key economic growth driver that accounts for 15% of Israel’s gross domestic product.

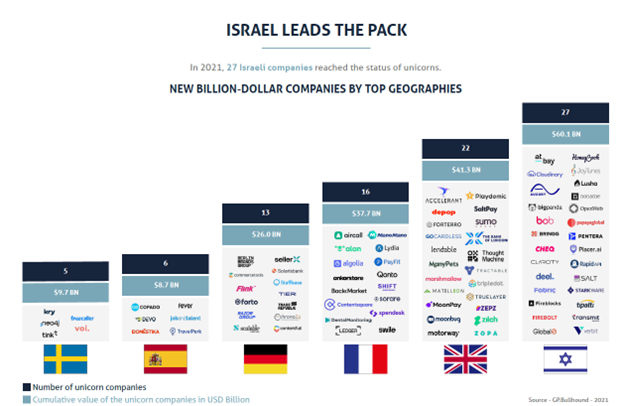

To set the stage, a unicorn is defined by a $1 billion company valuation and private equity ownership. Israel currently has 5.2 unicorns per million inhabitants, with a total population of nine million people, according to Israel 21c. By comparison, the United States has only one unicorn per capita, with a population of 329 million, meaning Israel has five times more unicorns than the United States, per capita.

What is Israel’s Secret Power?

The cultural importance of education in Israel is beyond anywhere else in the world, and the country has been ranked as one of the top educated in the world for many years regarding Israeli students’ dedication to completing college and graduate school. The value and importance of education have continued to grow, and discussions around why have often led to the fact that Jews were forced to learn and develop survival skills after facing persecution and living in a hostile environment. For decades, neighboring countries set out to destroy their homeland, and Israelis had no choice but to survive in a difficult environment. Often, that meant turning to entrepreneurship and innovation to find new ways to thrive. The resilience of the Israeli people is at the heart of their success story.

Investment Growth: Top Industries

While technology has made a major impact on venture capital and startup growth in Israel, it can be incorporated into and drive success for multiple industries. We break down some leading industries that are seeing success in Israel today.

Foodtech/Agritech:

The food industry globally is witnessing a major revolution. Technology is disrupting agriculture like never before. One reason for the development of the agriculture industry is the fact that we are limited in how we will feed 10 billion people in the world come 2050. The development of new technologies is also changing the way people create food in mass quantities.

The agriculture industry is now mature enough to be considered a significant and life-changing sector for tech investments, and Israel is well-positioned to lead the world in this field with major initiatives and projects.

For example, Champel Capital invested in Aleph Farms in 2021 to support the company in developing a 3D tissue engineering platform that grows real beef steaks directly from a healthy cow’s cells without killing the animal, creating opportunities to expand the meat market without harm to animals.

Healthcare Tech:

In recent years, only a very few VC funds have invested in Israeli deep healthcare technologies. But Israeli entrepreneurs have a proven track record of success in the field following massive support and investment from the government. Israel has become known for being a hotbed for medical technologies, with over 350 multinational R&D centers, and over 20 of those focused on MedTech. Although Champel Capital was not hesitant to invest in MedTech, the sector experienced a global lull in investments that may have generated a new wave of startups going into 2022.

Among others, Champel Capital invested in Vectorious in 2018, a company that developed the world’s first in-heart microcomputer using AI and cloud data to communicate health status with the physician.

AI/Fintech:

In recent years, some of Israel’s largest exits have emerged from these sectors, and the country has gained prominence as a leader in cybersecurity and AI. The country has leveraged elite intelligence units, leading academic institutions, and a dedicated entrepreneurial workforce to be a powerhouse in AI innovation and research. In 2020 alone, nearly 100 AI-focused companies launched in Israel, according to Deloitte.

Looking forward, Champel Capital believes that these sectors will create the most value in the country. Champel Capital invested in Lemonade in 2018, the world’s first open-source insurance policy. Lemonade runs insurance plans within 90 seconds and offers rental, homeowner, and pet health insurance powered by technology. The company was so successful that it became a unicorn in 2019 and went public in 2020.

Israel is quickly emerging as a global technological and entrepreneurial powerhouse on a massive scale. The Bloomberg Innovation Index, an annual ranking of countries that measures performance in research and development, technology education, patents, and other marks of technological prowess, listed Israel at #7 in the world in 2021. While many investments in Israeli tech companies are foreign, Champel Capital is proud to be supporting its home market and investing in Israeli business owners and founders.

The author Amir Weitmann is the Co-Founder and Managing Partner at Champel Capital. Established in 2017, Champel capital is a young and dynamic venture capital company with a spirit of entrepreneurship based in Jerusalem, Israel, and investing in deep-tech Israeli companies. As a leading venture capital fund, Champel Capital’s responsibility accompanies every investment. Alongside their global standards for protecting social and environmental elements, they implement active impact investing as part of their asset allocation.