Flowcarbon, a startup from Adam Neumann that is working to build the infrastructure for a market in the voluntary selling of tokenized carbon credits on the blockchain, is in serious trouble due to the recent crash of the crypto currency markets. The new company was forced to delay plans for the rollout of its token because of the situation.

Flowcarbon said that the company is waiting for the crypto markets to “stabilize” before moving forward. But some people wonder if cryptos can ever be stable.

Dana Gibber, CEO and Co-founder of FlowCarbon, admitted to The Wall Street Journal, “The token launch, expected by the end of June, has been shelved indefinitely.”

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

Flowcarbon has raised $70 million in venture capital funding and sale of its carbon-backed token.

Flowcarbon was co-founded by Dana Gibber, Caroline Klatt, Rebekah Neumann, Adam Neumann, and Ilan Stern, and is run by Gibber (CEO), Klatt (COO), and Phil Fogel (Chief Blockchain Officer). Flowcarbon currently has 35 employees with collective expertise in carbon, sustainability, and blockchain technology. Flowcarbon has offices in New York, Montana and Berlin.

Flowcarbon calls itself a pioneering climate technology company that brings carbon credits onto the blockchain. Its mission is to make carbon markets accessible and transparent, enabling billions of dollars to be invested directly into projects that combat climate change.

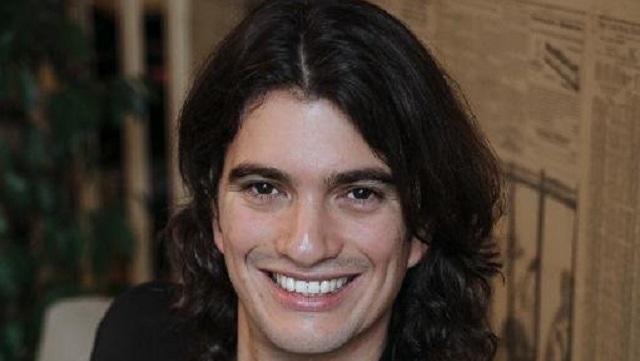

In 2019, Neumann was forced out of WeWork, the company which he founded in 2010. After a meteoric rise the entrepreneur was brought down after allegations of serious drug use and sexual improprieties were made. WeWork was forced to deal with sexual harassment suits. It delayed its planned IPO and laid off many workers.

And Adam Neumann reportedly walked away with a $1.7 billion deal.

So, some people may not be surprised that Flowcarbon is in trouble. WeWork proved to be nothing more than a house of cards and the whole crypto market is now looking like a Ponzi scheme itself. People who followed Adam Neumann’s career closely are probably saying “I told you so” right about now.