by Contributing Author

Bitcoin is now trading at $30,000 – in a flash down from highs more than double that. On-chain data shows that it is largely newcomers to crypto that were crushed in the selloff and sold their coins at a loss or were stopped out, losing some of the gains they once had behind.

Knowing when to take profit and at what level, along with what signs are showing that could suggest the market is turning around is something that only comes with experience. Bull market or not, assets experience deep corrections and the notorious crypto volatility has been mostly missing since Black Thursday. However, it is back in a major way. What’s a trader to do when stop losses can’t even protect about how sharp corrections can get? Covesting copy trading is the answer.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

What’s Behind The Crypto Market Mayhem

The recent crypto market volatility was the result of so much exuberance, greed, and therefore blindness across crypto. Money was being made by everyone who entered the market. Up until April, anyone who bought Bitcoin before then would have been in profit. An entire investor set being profitable due to easy money was bound to come to a catastrophic end.

Newcomers don’t know how to handle such madness in markets, and even long term holders were shaken by the worst monthly selloff on record. So how do traders protect against such movements?

Protecting Against Sudden Volatility: The Traditional Way

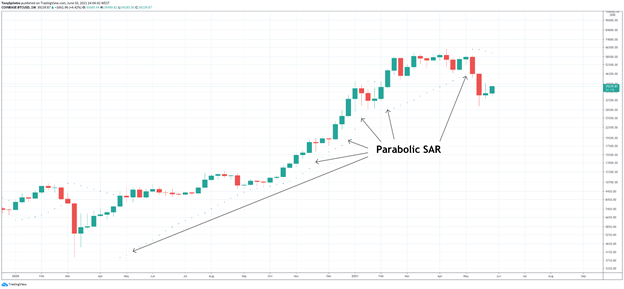

The most common way to protect against sudden volatility is to be certain to set a stop loss order on any position. Some trading platforms let traders edit orders to adjust stop losses and move them up in profit to ensure gains are realized before the market turns around. Traders can move stops along up with the indicator, which is offered for free as part of the built-in trading tools there.

For those getting into positions, placing stop losses too tight can lead to getting stopped out repeatedly, while leaving them too loose can defeat the purpose of protection. And in such extreme volatility, it can wick into resistance and support are common purposely to stop hunt positions.

Relying On Covesting Copy Trading Instead

Novices who are now at a loss and needing to recoup the gains you once had, might look for a solution that doesn’t involve them setting their own stop losses or managing positions. But they still also want to stay exposed to crypto.

Covesting copy trading lets anyone become a follower and follow strategy managers ranked among the global leaderboards. Risk and success metrics let these followers pick and choose only the best of the best, or those that perfectly suit their profit goals or risk appetite.

Strategy managers on Covesting came out of the recent crypto market crash not only as survivors, but in profit due to proper placement of hedge positions and more. These traders aren’t just ranked highly on the leaderboards, the rapidly growing peer-to-peer trading community now has garnered the interest of some of the most skilled out there.

Calling All Selloff Survivors To The Covesting Community

Short positions and trading Bitcoin on margin kept Covesting traders in profit while the rest of the market bled out. These traders know the tricks of the trade, and using the advanced trading tools, were able to take advantage of both directions of the market.

Anyone who themselves were one of the rare survivors or came out profitable in the chaos, Covesting could be your calling. By becoming a strategy manager yourself, you could rake in even more profits by banking on follower funds. Strategy managers automatically earn a cut from the success fees of follower’s copied trades, making each winning trade that much more lucrative.

For those that can or can’t handle the recent crypto market carnage, there’s a place for both skill levels, and each can profit alongside one another. The Covesting ecosystem is growing by the day. The new service is coming later this year and is yet another option for those that want to make money with crypto, but can’t stomach the crypto market volatility.