Mark Cuban is surely the kind of person who you would ask for investment tips. Not so much for a tip on a hot stock as they say, but more for general ideas of how best to make your money grow.

Obviously, the billionaires can afford to make big investments, become activist investors, buy out whole companies and get the big hedge funds to take their money and do all of the investment work for them. But you, me and more than 90% of all people do not have that much in capitol just lying around.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

This, however, does not mean that we cannot learn from the investment philosophies of the major players out there.

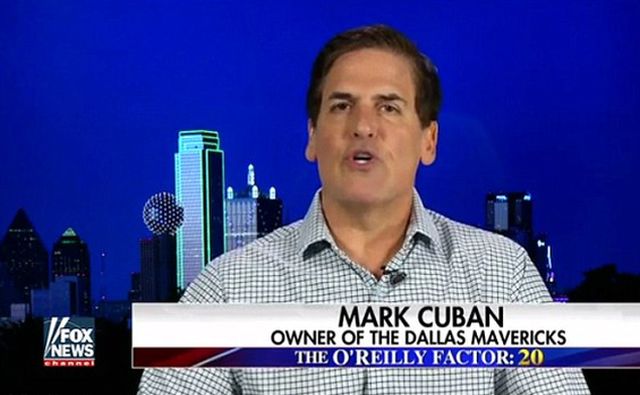

So here now is part three of our series on investment tips from the most successful investors. You can see our previous articles on how George Soros and Carl Icahn invest their money. And now its Mark Cuban’s turn.

Pay Off Debt

If you find yourself with extra money, lets say from a tax refund or an unexpected inheritance, the first thing that Mark Cuban would do is pay off any currently held debt. This is especially so with credit card debt.

People pay high rates on their credit card debt. This gives them nothing in return and they do not realize that this form of deferred payment just raises the price of all items purchased. Just add however much you might have paid the credit card company in a given year for letting you owe to the prices of whatever you bought which was not essential.

“Using a credit card is OK if you pay it off at the end of the month,” Cuban said in an interview with Yahoo. “Just recognize that the 18% or 20% or 30% you’re paying in credit card debt is going to cost you a lot more than you ever could earn anywhere else.”

Would you have really gotten that new model smart phone or tablet if the price had been double or even triple what was listed? Probably not. So if you have some sort of windfall pay of debts first before even thinking of making any investments. The interest that you are paying on it is probably higher than any expected returns on an investment.

Don’t Put More Than 10% in Risky Investments

They always say the greater the risk the greater the reward. So if you think that there is a chance to even double your money (this rarely if ever happens) then there is a much higher probability that you will lose your shirt.

So do as Mark Cuban advises and never put more than 10% of your money in something risky. That is 10% of the funds which you have set aside for investments.

“If you’re a true adventurer and you really want to throw the hail Mary, you might take 10 percent and put it in bitcoin or Ethereum, but if you do that, you’ve got to pretend you’ve already lost your money,” Cuban once told Vanity Fair.

Save Your Money First

Mark Cuban advises that people be sure to have enough cash available to pay their day to day living expenses for up to a year before investing. In other words, if you are not looking for what to do with your already existing retirement fund then start saving fist. Once you are sure that you can make the rent and buy the groceries regardless of what happens with your investment then you are ready to risk money on the markets.

Remember, even if your investment does not drop, you will need to be patient and wait a while for results. The money that you put away will probably need to be left in whatever account or fund for years.

Mark Cuban told CNBC, “Once you’re able to save [for] a year of expenses, then you can start investing and putting it into something that can appreciate, like a low cost mutual fund or the Standard and Poor’s Index.”

Don’t Be Impulsive: When you don’t know what to do, do nothing!

Probably the worst thing that an individual investor can do is rush things. Don’t ever make quick moves like selling off one investment to put the money all in something else just because you heard something on the news. Avoid fads or trends. Be patient.

Day trading doesn’t really work. Think through each and every move that you make ahead of time. Wait a few days before deciding on changing your investments.

Mark Cuban warned would be investors on LinkedIn, “Remember the market is where it was less than a year ago. No one freaked out when it went up too fast. No reason to freak out when it goes down quickly. Remember, I follow the No. 1 rule of investing: When you don’t know what to do, do nothing.”

Invest in Yourself

Mark Cuban told Men’s Health in an interview, “When you’re first starting, you may or may not have a job. You don’t have any money. You [have] complete uncertainty about your career. But what I learned early on is that if I put in the effort, I can learn almost anything.”

So take the time and put in the effort to learn. You need to teach yourself about investments. There is plenty of information out there. If you are going to risk your money then invest some of it in a subscription to a serious financial publication or a credible website/service which offers daily information and online tutorials.

For more information on that read “Top 5 Websites for Investment Advice.”