Israeli firms Coralogix, TetaVi, Papaya Global, and BioCatch have somehow managed to raise a total of $91 million in new funding among them. This even as Israelis are suffering through a total nationwide lockdown due to the Coronavirus.

Wow!

BioCatch, researches people’s digital behavior by from a physical and cognitive perspective in order to protect one’s digital identity. It added $20 million to its Series C bringing in a total of $168 million for the round of investment. The money came from major banks Barclays, Citi, HSBC and National Australia Bank (NAB). BioCatch has also the BioCatch Client Innovation Board which will work with banks to fight identity fraud.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

“BioCatch is defining a novel category in digital engagements and has an impressive success record in the financial industry,” said Ornit Shinar, Head of Ventures Investments in Citi Israel. “We are excited to add BioCatch to the Citi Ventures portfolio.”

“We are extremely excited that five of the largest and most important global financial institutions are working with BioCatch to jointly address today’s most pressing problems in the areas of online fraud, account authentication and digital identity,” said Howard Edelstein, BioCatch Chairman & CEO. “We have already seen the power of collaboration in solving difficult problems in other areas of the financial services industry, such as clearing corps, transaction networks, post-trade processing, margin calculation and collateral management, when banks work together and share knowledge, workflow and data in the common interest.”

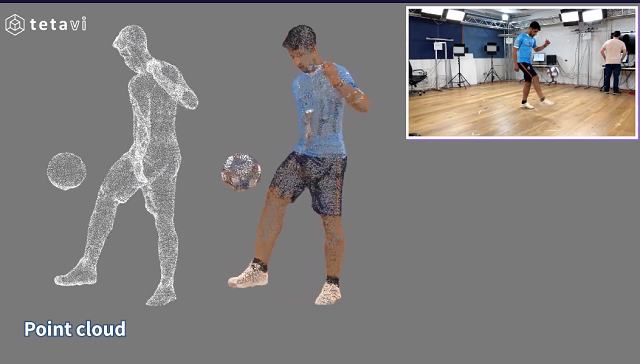

TetaVi, which produces 3D and hologram tech using high quality volumetric video content, raised $6 million in a Series A. American and Canadian venture capital fund REDDS led the investment.

“We view this latest funding round, raised during a time of significant financial uncertainty, as a vote of confidence by our existing and new investors in the growth of the immersive experience market and our ability to cater to its evolving needs,” said Gilad Talmon, TetaVi’s CEO. “The funding will allow TetaVi to enhance our current capture studio offering and will enable us to add highly qualified personnel required in order to widen the scope of our volumetric video capture solutions.”

Coralogix, which offers a platform that lets IT people monitor and analyze the data their software produces, raised $25 million in a series B round. Red Dot Capital Partners and Eyal Ofer’s O.G. Tech led the investments.

Too much information, or TMI, is not just about personal comments. It also refers to how we are now overwhelmed by so many sources. We all need a way to organize and better analyze data.

“We’ve experienced significant market traction this year as companies seek modern ways to manage and analyze their logs Yoni Farin, Coralogix’s co-founder and CTO said. “We’ve added over 500 customers just in the last six months, and that’s just scratching the surface. To sustain this growth, we’ve set ambitious plans to grow our engineering team so we can meet the high standards of quality our customers have come to expect from our product.”

Papaya Global, which offers a platform that simplifies payrolls for large companies, was the biggest winner for Startup Nation during his holiday season snagging $40 million in new investments. The funding was led by Scale Venture Partners, with participation from Workday Ventures, Access Industries (via its Israeli vehicle Claltech), and all existing investors: Insight Venture Partners, Bessemer Ventures Partners, New Era Ventures, Group 11, and Dynamic Loop.

Papaya boasted in a statement that, “in an effort to improve the experience of our clients’ employees, we launched a unique global equity management solution and support for contractor management. In January 2021, we will launch our new HRIS offering. A number of other exciting tools are planned for 2021.”

Papaya’s platform supports both fast-growing clients and Fortune-ranked clients. It also offers an end-to-end solution for all types of global employment (payroll, EOR, and contractors) across more than 140 countries.

The company was founded in 2016 by its CEO Eynat Guez and Ofer Herman. Guez told Globes, “Raising the funds is for future strategy, and we are able to choose the world’s best investors.”

“I tell my investors that you cannot teach me about payroll but I’ve a lot to learn about how to take a company and grow it and take it public. It’s always easy to be smarter in retrospect but we don’t want to say in another year that the market is in recession and nobody is raising money and it’s a shame that we didn’t raise money. In such a situation companies can go into a spin and move from growth to survival. If we can avoid a bad time then why not?”