Israeli company IronSource is negotiating for a $1 billion deal with a Chinese fund. Calcalist has learned that the company has been negotiating for two months, apparently against Primavera Capital. The Chinese fund, which manages $2.9 billion, is expected to bring one or two partners into the deal.

IronSource is a digital content company which offers monetization and distribution solutions for app developers, software developers, mobile carriers, and device manufacturers.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

This is not the first time that IronSource has been in contact with a Chinese fund. Last year, the company negotiated with CDH, which manages assets worth $19 billion, but the negotiations did not ripen into the deal.

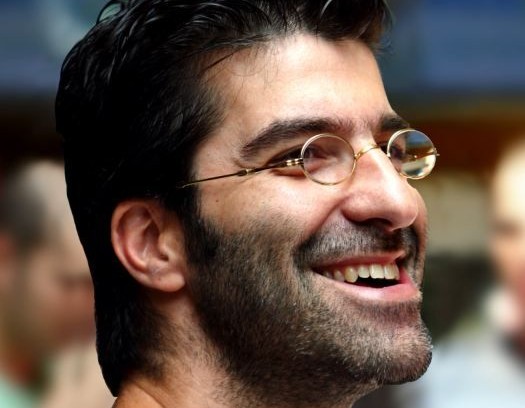

IronSource was founded in 2009 by CEO Tomer Bar-Ze’ev, and the brothers Eyal, Itai and Roy Millard, joined by Tamir Carmi, Omer Kaplan, Arnon Harish and Netanel Shadmi. They are all entrepreneurs of startups IronSource acquired. IronSource raised approximately $123 million in received funding to acquire startups ahead of IPO from a group of international investors. The company has over 700 employees with half dedicated to R&D.

IronSource’s has three products: ironSource Aura is a smart content recommendation platform, Ad Mediation platform is an app monetization solution and Campaign Manager is a user acquisition solution. Its main product is InstallCore, for installing software on computers and distribution tools for developers on PC and Mobile. The Company’s revenues are generated from the sale of advertising on the installation software.

In September 2015, it merged with Israel’s SuperSonic in a deal that reflected more than $1 billion in valuations, and in fact created Israel’s largest Internet company in terms of value and revenue.

Founded by Eric Czerniak and Gil Shoham, SuperSonic has developed a platform for advertising in mobile applications in video format and banners, an advertising management system and a stock market for advertising space. Its customers are mainly entertainment companies, including EA and Zynga, the Chinese messaging company WeChat, the travel companies Expedia and hotel.com.

IronSource Merges With Supersonic In Mobile Ad Consolidation Play

The latest deal IronSource made was in June 2017, when it bought Israeli video advertising company StreamRail for several million dollars. The company, which was invested by the US venture capital fund Sequoia, developed a technology used by content organizations and advertising networks to generate revenue from video content. In addition, in 2013 IronSource acquired AfterDonoD for $28 million.

According to Calcalist, the company’s revenues in 2016 was $450 million. Operating profit EBITDA was $80 million, and net profit was estimated at $50 million.

In July 2017 the company distributed a dividend of $50 million to its shareholders, including Carmel Ventures, Saban Capital Group, Disruptive VC, Leumi Partners, Access Industries, Ping An Ventures and China Broadband Capital.

Len Blavatnik’s Access Industries Leading $25 Million Investments in IronSource

Some of IronSource shareholders are interested in realizing their holdings in the company. US technology companies that could be candidates for the acquisition are few, and an IPO on Nasdaq is considered unprofitable because of the concern of American investors in the areas in which the company is engaged.

On the other hand, Chinese entities have been considered active buyers in recent years.

Primavera Capital, which is apparently negotiating for the acquisition of Iron Resources, is a global investment company based in China. It has offices in Beijing and Hong Kong, and manages yuan funds and dollar funds for leading institutions, corporations, and families in China and abroad. It was founded by Dr. Fred Ho, a former partner and chairman of the Greater China Group of the Goldman Sachs Group, which currently serves as a managing partner of the fund. Primavera Capital currently employs 30 investment professionals.

The Chinese fund has recently been negotiating to acquire control of the Israeli irrigation company Netafim. Last week, however, the control was sold to Mexicam, Mexican counterparts for $1.5 billion. Primavera retired late in the tender.

Carmel Ventures did not respond to Calcalist.

Tomer Bar-Zeev, CEO of Iron Sources, told Calcalist in response: “How many times can you write that AeroSource is negotiating to be sold to Chinese companies? there are always calls from Chinese bodies to buy the company, and Primavera has also turned to us, but there are currently no negotiations for sale with any one.”

By Golan Chazani, Calcalist in Hebrew Version