–

Starwood Waypoint is raising capital to increase its portfolio and buy back stock.

–

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

Starwood Waypoint Residential Trust, a California based single-family rental real estate investment trust, announced yesterday that it has commenced a private offering of $150 million aggregate principal amount of Convertible Senior Notes due in 2019. The Company plans to grant the initial purchasers a 30-day option to acquire up to an additional $22.5 million aggregate principal amount of Convertible Senior Notes.

The proceeds from this offering, according to Starwood, will be used to acquire additional homes and distressed and non-performing residential mortgage loans, to repurchase its common shares and for general business purposes.

The Convertible Senior Notes will be unsecured, are expected to pay interest semiannually and will be convertible under specified circumstances and during certain periods based on a conversion rate to be determined. Upon conversion, the Company will pay or deliver, subject to the terms of the indenture governing the Convertible Senior Notes, cash, common shares of the Company or a combination of cash and common shares of the Company, at the Company’s election.

Unless repurchased or converted in accordance with their terms prior to such date, the Convertible Senior Notes will mature on July 1, 2019. Other than to the extent necessary to preserve its status as a REIT, the Company will not have the right to redeem the Convertible Senior Notes prior to maturity. The interest rate, conversion rate and other financial terms of the Convertible Senior Notes will be determined by negotiations between the Company and the initial purchasers.

The company stressed that its announcement was “neither an offer to sell nor a solicitation of an offer to buy the Convertible Senior Notes or the common shares issuable upon conversion of the Convertible Senior Notes.”

A senior convertible note is a debt security with an option to be converted into a determined number of the issuer’s shares. Senior convertible notes have priority over all other debt securities issued by the organization. In addition, the bondholder has a call option. This is why such bonds tend to come with low interest rates.

Based in Oakland, California, Starwood Waypoint Residential Trust acquires, renovates, leases, maintains and manages single family homes. The real estate firm says that it is reinventing renting by building a leading, nationally recognized brand based on a foundation of respect for its residents and the communities in which it operates. Its chairman is Barry Sternlicht.

It is an indirect subsidiary of, Starwood Capital Group, an American private investment firm focused on global real estate, hotel management, oil and gas, energy infrastructure and securities trading, Headquartered in Greenwich Connecticut . Starwood operates Starwood Property Trust, Inc., Starwood Energy Group Global, L.L.C., Starwood Real Estate Securities, L.L.C., and SH Group.

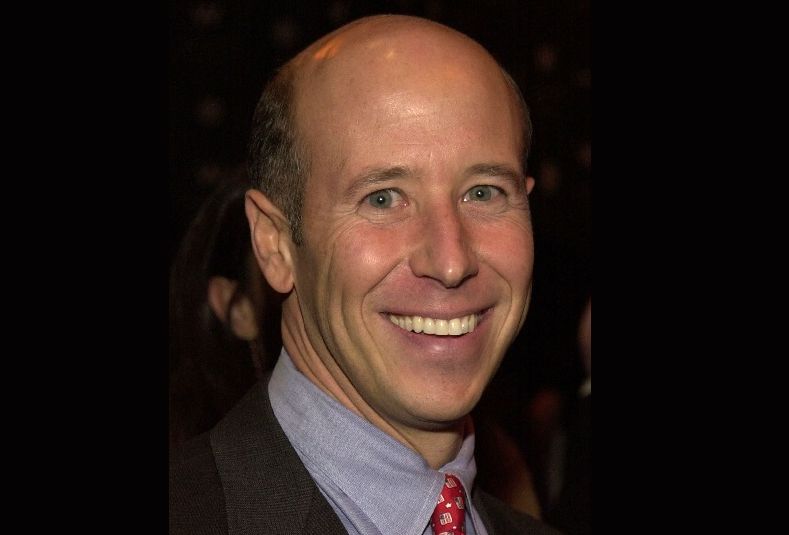

Barry Stuart Sternlicht is a self-made man and the founder, chairman and CEO of Starwood Capital Group, a private investment firm focused on global real estate, energy, infrastructure and securities trading. He is also chairman of Starwood Property Trust, now the largest commercial mortgage REIT in the United States traded on the NYSE and Chairman of SWAY.

Born in New York City to a Holocaust survivor, Sternlicht graduated magna cum laude, with honors, from Brown University in 1982. In 1986, he received his MBA with distinction from Harvard Business School. After graduation, he went to work for JMB Realty, a real estate investment company, in Chicago where he learned the real estate business. In 1989, after the real estate market collapsed, he was laid off and went into business for himself.

Mr. Sternlicht has structured investments with an asset value of approximately $47 billion.