–

–

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

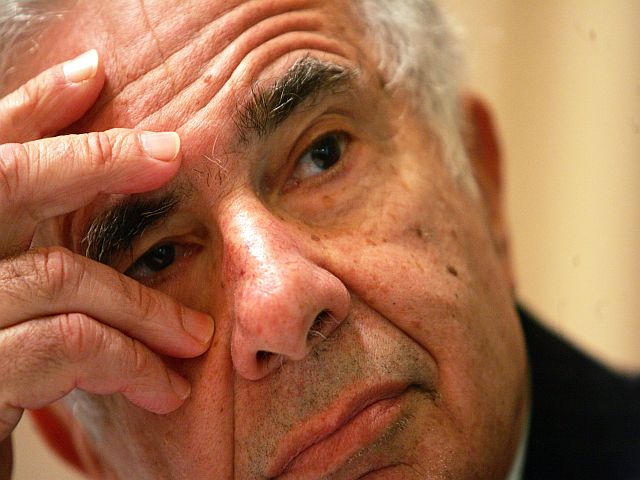

Sometime activist investor Carl Icahn has just reported to the SEC a continued accumulation of shares of Apple Inc. His continued purchases seem to be motivated, moreover, without any remaining critical intentions against the company, or its management. On the contrary, Icahn seems to be doing it simply because he believes they are cheap and are likely to do well.

Apple has lately continued with its own long range game plan, for developing its business, with its customary complete lack of concern for pandering to analysts, or others on Wall Street, who may have trouble figuring it out.

Accordingly, some investors have left the company in what is a polarising story. Others, including Icahn himself, are indeed putting their faith in the company’s ability to continue to radically reinvent itself over time, one more time, with one more next great thing.

After an institutional investor run-off earlier this year, even so Apple’s shares have been doing well lately, currently sitting around US$589 per share and again providing a market capitalisation of a little over US$500 million.

A number of rumoured new products are close to entering the production pipeline too, so a number of people are creeping cautiously back off the fence again.

In the first quarter of 2014 Icahn added 2.8 million shares alone to his Apple holding. Now he has built up his stake to 7.5 million shares, or a little less than 1% of the shares outstanding.

With a current value of some US$4.4 billion, Carl Icahn has already made about 19% on his money after an average hold period of perhaps somewhere around six months.

Icahn has also expressed the view that Wall Street just doesn’t understand the company; with the disclosure of his increased holding he is certainly continuing to put his money where his mouth is.

June 2nd is the record date for the company forthcoming 7 for 1 share split, which will take place on June 6th. At the current level this will bring the share price down to US$84, or so, and may then also make it more affordable for the average small investor.

–