–

The deal will be the biggest private equity buyout deal in South Korea since 2008.

–

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

–

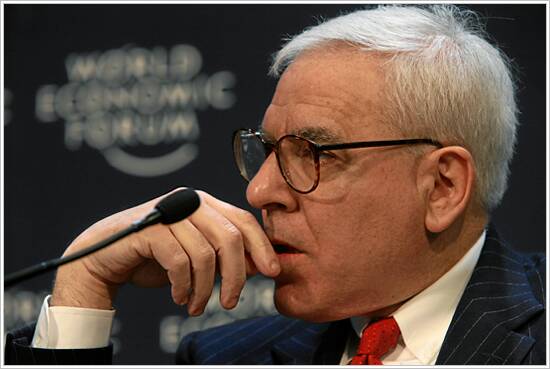

The Carlyle Group, the New York based global alternative asset management firm, co-founded and led by co CEO David Rubenstein, has agreed to buy 100% of Tyco’s Korean security business, known as ADT Korea. Tyco currently operates its business in South Korea through four separate business entities: Tyco Fire & Security Services Korea and its three subsidiaries ADT Caps, Capstec and ADT Security.

Carlyle Group will effect the acquisition in an all- cash transaction valued at approximately US$1.93 billion (including debt assumed). The deal will be the biggest private equity buyout deal in South Korea since 2008. The acquisition is expected to close in the second quarter of 2014, subject to customary closing conditions and required regulatory approvals.

–

ADT Korea provides advanced security solutions in South Korea, serving approximately 475, 000 small-and-medium-sized businesses, commercial and residential customers. The business provides central monitoring services, with video surveillance and dispatch, access control and other customized security solutions as well as guarding services.

Headquartered in Seoul, South Korea, ADT Korea has approximately 7, 500 employees and a nationwide network of branches. According to Tyco for the fiscal year to September 30th 2014, ADT Korea had been expected to generate revenue and operating income for them of approximately US$600 million and US$125 million, respectively, with an EBITDA margin of approximately 30%, or about US$180 million. On that basis the enterprise value of the transaction translates to a multiple of about ten times EBITDA.

–

–

Sanghyun Lee, a Managing Director of Carlyle’s Asian Buyout team, said, “ADT Korea is a highly stable and profitable business with attractive market positioning, strong brand power and excellent cash flow profile. Korea is one of the few countries in Asia that generates stable economic growth along with consistent deal flow of large buyout transactions. Carlyle’s investment in ADT Korea once again accentuates our long-standing commitment to Korea since the establishment of Carlyle Korea in 1999.”

Cedric Bobo, a Principal of Carlyle’s US Buyout team, said, “This is a great opportunity to create value by leveraging Carlyle’s deep industry expertise and global network to support future growth and realize ADT Korea’s full potential as it transitions into a standalone company.”

George Oliver, Chief Executive Officer of Tyco who are selling the business, said, “ADT Korea is a healthy and profitable business and a leader in the South Korean market, with a strong management team and highly dedicated employees. We are grateful to them for their contributions to Tyco and know they will continue to thrive within The Carlyle Group.”

Carlyle has invested more than $920 million of equity in 17 separate transactions in South Korea, as of December 31, 2013. To help pay for this new one Carlyle Group has secured committed debt financing from a banking syndicate comprised of Korea Exchange Bank, Kookmin Bank, Industrial Bank of Korea, Korea Investment & Securities and UBS AG.

About The Carlyle Group

The Carlyle Group is a global alternative asset manager, listed on Nasdaq, with approximately US$189 billion of assets under management across 118 funds and 100 fund of funds vehicles as of December 31, 2013.

Carlyle’s purpose is to create value on behalf of its investors, many of whom are public pension funds. Carlyle invests across four segments – Corporate Private Equity, Real Assets, Global Market Strategies and Solutions – in Africa, Asia, Australia, Europe, the Middle East, North America and South America.

Carlyle has expertise in various industries, including consumer & retail, energy, financial services, aerospace, defense & government services, healthcare, industrial, real estate, technology & business services, telecommunications & media and transportation. Currently Carlyle employs more than 1, 500 people in 34 offices around the world.

–