–

International specialty pharmaceutical company Actavis, which is headquartered in Dublin, Ireland, and listed on the New York Stock Exchange ACT (NYSE), has entered into a definitive agreement to acquire US pharmaceutical company Forest Laboratories, which is also listed on the New York Exchange and which is headquartered in Manhattan.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

Under the terms of the agreement Actavis, which has its US headquarters in Parsippany-Troy Hills, in New Jersey, will acquire Forest for a combination of cash and stock. Actavis will pay US$26.04 in cash plus 0.3306 Actavis shares for each Forest share. This ratio valued Forest at US$24.3 billion, or US$89.48 per Forest share, based on the previous closing price of Actavis’ shares.

–

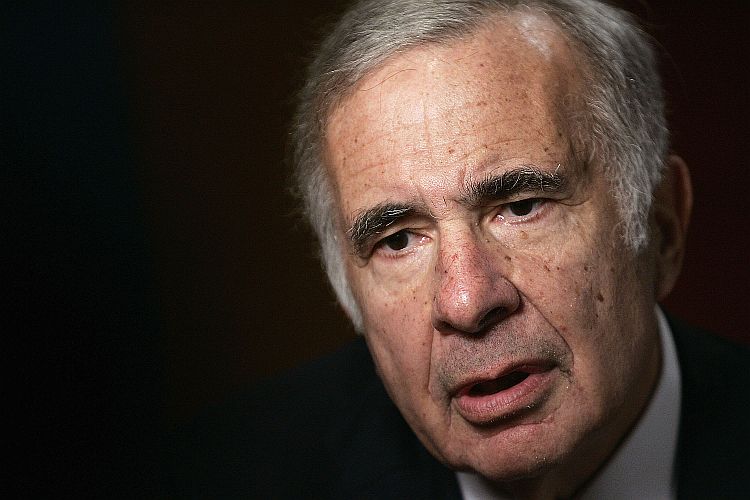

Activist corporate investor Carl Icahn has owned a substantial position in Forest since 2011. After several unsuccessful proxy calls he made for change there, eventually he succeeded in installing his own hand picked CEO last year, Brent Saunders, who has now done the deal with Paul Bisaro who leads Actavis. As at December 31st, 2013 Icahn still owned an11% position in Forest and he stands to make a very large profit once the deal closes.

The agreed acquisition price announced represents a premium of 25% over Forest’s previous closing price, and actually a 31% premium over its 10 day volume weighted average stock price up until Friday February 14th, 2014. Since the difference between the two is relatively slight this implies very good security was kept throughout the negotiation right up until the announcement, without significant leaks – a professional result and one which is not always the case.

Forest’s 271 million outstanding shares have now jumped sharply today to match the deal price, to over US$92 per share, with its resulting market capitalization slightly exceeding even the initial bid value.

Actavis’ own 174 million outstanding shares also rose 7% after the announcement, trading at around US$205 per share today, for a pre-transaction market capitalization of over US$35 billion. This therefore also increases the total value of the bid slightly, to US$25.4 billion, just above where the Forest valuation itself has settled for the moment.

Paul Bisaro, Chairman and CEO of Actavis said, “With this strategic combination, we create an innovative new model in specialty pharmaceuticals leadership, with size and scale, a balanced offering of strong brands and generics, a focus on strategic, lower-risk drug development, and – most important – the ability to drive sustainable organic growth.”

Actavis had succeeded last year in moving its corporate headquarters and founding jurisdiction to Ireland, after acquiring another pharmaceutical company there, Warner Chilcott. This has the benefit of offering lower average corporate tax rates. Once the deal with Forest ultimately closes, Forest should be able to take advantage of this as well.

Brent Saunders, CEO and President of Forest said, “The combination of Forest with Actavis creates a specialty company with annual sales of approximately US$15 billion, a diversified portfolio and a geographically balanced business, ” adding, “This compelling combination gives us more optionality to drive future growth and sustainable shareholder value due to our expanded geographic and therapeutic presence, ability to drive new product flow through R&D, strong balance sheet and consistent cash flow.”

Paul Bisaro will lead the, soon to be, newly combined company, unless another bidder turns up in the mean time, and Brent Saunders will join the board of Actavis, which will be the surviving public entity under the terms of the acquisition. Having been brought in by Cark Icahn after running Bausch & Lomb for him, where they also made a big profit, he has certainly done his job.

Carl Icahn must be delighted with the outcome. Depending on when he bought in in 2011 the Forest share price was somewhere in the thirty dollar range, so he has likely made at least about two and a half times his money. US$25 billion x 11% is US$2.8 billion in total, so there could be a more than US$1.5 billion profit sitting in there for him.

As a distinguished member of the Twitterati now, Icahn tweeted today after the announcement in his own inimitable style: “Great result for ALL $FRX (Forest Labs) shareholders – proves again that activism works.”

Which he then immediately followed up with another tweet saying: “Since our involvement, $FRX

Both Actavis and Forest have grown substantially in the past by acquisition, which has increasingly been the strategic preference of many drug companies given the expense and high risk of internal drug development through proprietary R&D, particularly with an ever more complex regulatory environment as well in recent years.

However Actavis apparently plans now to aggressively develop more new drugs of its own, Bisaro has said and the budget is there to invest US$1 billion in research and development in the coming year. Maybe there will indeed be enough cost savings in the back office to leave more money to spend on real investment in the future.