–

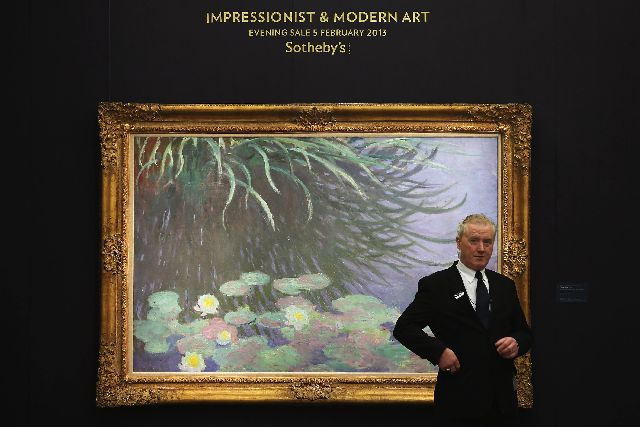

Sotheby’s Inc, the international art auction house based in New York, led by its Chairman and CEO Bill Ruprecht, yesterday announced the results of an internal strategic review of its businesses and capital allocation policies.

Last August, New York based Third Point, the activist hedge fund led by Daniel Loeb, announced it had taken a significant position in the venerable art auction house and fairly aggressively demanded change, including large returns of cash to shareholders.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

The implication was the company was under performing and failing to best exploit all its assets, including its flagship headquarters property in New York.

Sotheby’s response was to put in place a standard, plain vanilla, poison pill, a.k.a. shareholder rights plan. These are well crafted under US law and can significantly delay, or thwart completely, unwanted corporate suitors.

In addition Sotheby’s announced it would strategically review all its businesses, and the best uses for its capital, promising to respond early in the new year. Now it has done so.

For a while there the spat with Third Point had even gotten downright personal too, with Daniel Loeb issuing in October an open letter to the Sotheby shareholders indicating he had increased his position to 9.2% in the company, but also offering scathing, almost vitriolic, criticism of Bill Ruprecht including of how he was managing the business.

Since the company’s shares, which are listed on the New York Stock Exchange with the apt symbol “BID” have gone up over 40% in the last year, which is absolutely the best way to keep your institutional shareholder base happy, it was not entirely clear whether Daniel Loeb had picked a target weak enough to just roll over, or for him to prevail without a serious fight.

Accordingly, after due deliberation, the Board of Directors of Sotheby’s has now revealed the results of its, prudently undertaken, careful strategic business review. Essentially the company is fighting back, but is doing so by agreeing with Loeb on the cash issues – but only gradually and, it seems, entirely on their own terms.

The bottom line is the company has now decided to pay a special dividend to shareholders of US$300 million in March. Whilst not as much as Loeb was agitating for, it is a bribe to its shareholders large enough to likely be acceptable, one might think, taken in the overall context of a business still doing reasonably well. Score one for Bill Ruprecht.

Second, Sotheby is splitting up its two main businesses internally into two separate divisions, each with its own clear capital structures. the first is its agency business, i.e. the fine art auction and luxury real estate brokerage businesses, and the second is its financial services business – mostly its fine art financing business, one assumes. They are indeed separate in kind though obviously one feeds the other to some extent.

By giving them each their own balance sheet within the overall corporate umbrella, with target desired returns on capital to be achieved by each the company hopes to drive long term value creation for its shareholders, according to their announcement.

Achieving a 15% ROI on the agency business and 20% ROE on its financial services business has been set as the initial performance goal therefore. Sotheby’s also hopes to achieve general cost savings as early as this year of about US$22 million as well.

In addition to the special dividend the board of Directors of Sotheby’s has also authorized a US$150 programme of share buy backs, with the goal to spend as much as US$25 million within this programme by the end of 2014.

Sotheby’s also expresses the intent to “return any excess capital to shareholders on an annual basis, primarily through a special dividend” – though it remains unclear how that should be defined, or what it may lead to.

The company does provide a clue however, as it states it is indeed currently also evaluating its real estate holdings both in New York and London, including the possibility of selling its New York flagship headquarters. A bidding process is now apparently already under way to evaluate these alternatives.

If you want to deflect a determined adversary the soft arm of an embrace is as good a way to do it as any. This seems to be quite a comprehensive approach, and how the shares respond will indicate what shareholders think of it in the weeks ahead.