–

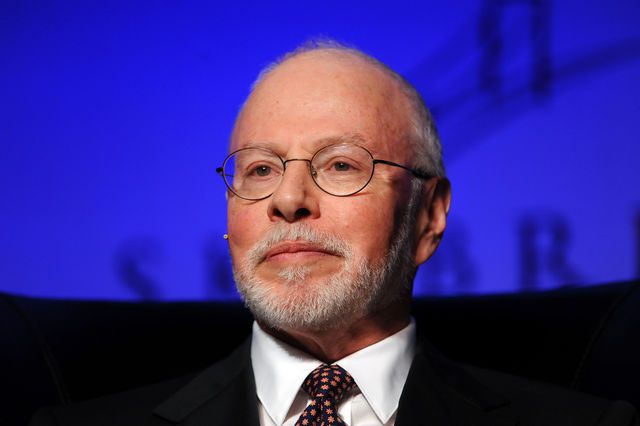

Paul Singer/ Getty

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

–

US pharmaceutical distributor the McKesson Corporation has been bidding to buy the German company Celesio in a US$8.2 billion transaction, including debt assumed.

Last October it had secured a commitment from Franz Haniel & Cie, on behalf of the founding family of Celesio to sell 50.01% majority control of the business.

McKesson then made a follow up offer to all the remaining Celesio shareholders at the same price. However in order to be able to meaningfully merge the two entities post-acquisition McKesson had set a condition that at least 75% of the company’s shares be tendered to it under its offer.

At that point American gunslinger Paul Singer’s hedge fund Elliott Management got in on the act looking for some greenmail, and built a potentially blocking position of his own of close to 25%, including shares that could be converted from some of Celesio’s outstanding convertible bonds.

After some delay, which perhaps created some negative sentiments along the way McKesson increased its bid, but only very slightly.

At this point, and after looking at his options Paul Singer decided to throw in the towel and withdraw his objections to the bid. As the Euro had gained a little in the mean time the bid had already improved further in his direction anyway.

Now McKesson has just announced that by the deadline for shareholders to tender their stock the company had failed to reach the 75% threshold and therefore the offer was now suspended.

Gritting his teeth, John H. Hammergren, the Chairman and Chief Executive Officer of the McKesson Corporation said in reacting to the news, “While we are disappointed that we were not successful in completing our offers for Celesio, we have a track record of great performance, a strong balance sheet and demonstrated leadership and scale across our markets, ” … “We are well positioned and will continue to explore and evaluate opportunities to further strengthen our businesses through our disciplined approach to capital allocation.”

A major defeat for McKesson, certainly after expending a great deal of time, trouble and quite a few dollars in setting the offer up, and for the founding family who had been hoping to sell, but perhaps economic nationalism played a part in the rejection if McKesson had not spent enough time wooing the shareholders other than the founding family itself.

A pyrrhic victory for Paul Singer therefore? He probably can get out with a small profit so may feel neutral about it, depending on the average price he paid for his stock over the last few months, and the Celesio shares have now fallen about 5% on the news. Alternatively he could push forward and try to buy the Haniel position himself and end up taking over the company. With his own stock, plus their 50.01% , he can’t be far away from the 75% threshold he would also want to attain if he waits a bit longer for those who generally are slow to tender their shares in these kinds of transactions to come on board. Up to him.

That is the interesting part about the M&A business; it can turn on a dime. And if you are not seen to be a successful predator you can become the prey quickly yourself, just by having appeared on somebody’s radar screen from the publicity. McKesson’s shares also dipped about 5% after the announcement that the deal had fallen apart. John Hammergren might therefore even have a few anxious moments himself in the months ahead until he drives forward with a new strategy for his company.

–