–

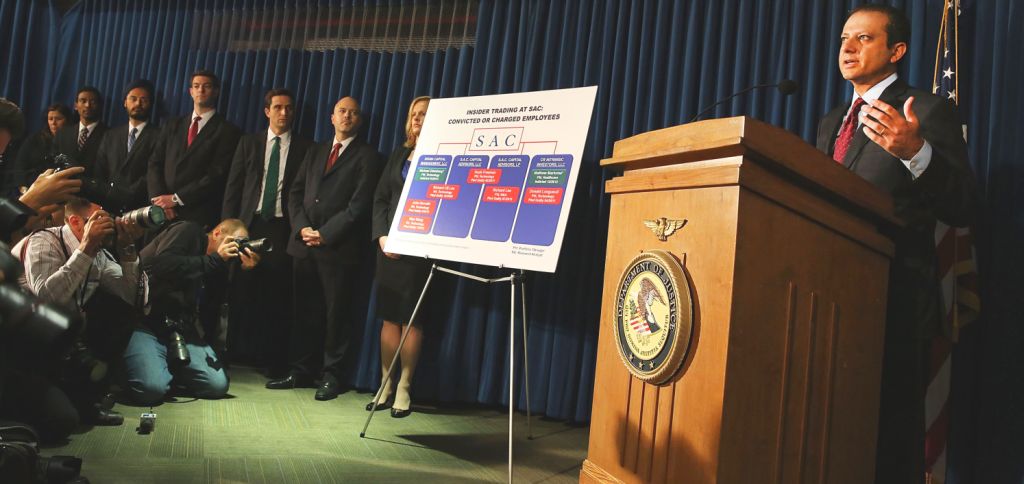

U.S. Attorney for the Southern District of New York Preet Bharara and Assistant Director-in-Charge of the New York Field Office of the FBI announce insider trading charges against SAC Capital / Getty

U.S. Attorney for the Southern District of New York Preet Bharara and Assistant Director-in-Charge of the New York Field Office of the FBI announce insider trading charges against SAC Capital / Getty

–

/By Clive Minchom/

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

The United States Justice Department has now gone ahead and charged Stephen Cohen’s hedge fund SAC Capital advisors with four counts of criminal securities fraud and one count of wire fraud. Under a legal theory of corporate criminal liability for the acts of some of its individual employees the hedge fund itself has been indicted, but not its founder, Steven Cohen.

Federal prosecutors say in the indictment the fund was involved in “systematic insider trading” that allowed it to make hundreds of millions of dollars in illegal profits.

Preet Bharara, the United States Attorney for the Southern District of New York, which has brought the indictment, said the scheme was “substantial, pervasive and on a scale without known precedent in the history of hedge funds.”

Prosecutors say in the indictment the alleged crimes date back to 1999 and continued until at least 2010. Their allegations state that SAC obtained inside information on publicly traded companies, traded on that information and boosted their own profits thereby.

“SAC’s relentless pursuit of an information ‘edge’ fostered a business culture within SAC in which there was no meaningful commitment to ensure that such ‘edge’ came from legitimate research and not inside information, ” court filings said.

SAC rejects the accusation and says it will continue to operate as normal. It says in a statement it had “never encouraged, promoted or tolerated insider trading”, adding that it took its compliance and management obligations seriously.

–

Last week the Securities and Exchange Commission (SEC) had made administrative civil charges against Steven Cohen personally, charges, which he has also rejected as unfounded.

With criminal fraud charges now hanging over the firm it remains to be seen whether the company can survive at all, or be reduced to a much diminished size trading only for its own account as the act of indictment alone – a 41 page document – may well continue to scare off many of its outside investors, on reputational grounds alone.

This week Richard Lee an SAC portfolio manager responsible for directing a $1.25 billion “special situations fund, ” pleaded guilty to insider-trading charges according to the Manhattan U.S. Attorney’s office, when his plea documents were unsealed. Lee became the eighth current or former SAC Capital employee to be charged or convicted on such charges, and with so many individuals under indictment this became the basis presumably for the theory of corporate criminal liability, which can treat a corporation as a legal “person” capable of being charged with criminal acts.

The general public will no doubt be pleased, as Wall Street has been notable in recent years for similar such scandals where the individuals concerned received severe penalties yet their employers – major banks and trading groups – simply got off unscathed or by paying “merely” very heavy financial penalties.

By cracking down now on SAC a strong message is being sent out to Wall Street yet again, as it was in the days of Ivan Boesky and Michael Milliken twenty years ago, that it had better tighten up. Unluckily for SAC, while a large company it is definitely not “too big to jail” in the paraphrased words of testimony given by Attorney General Eric Holder to Congress in March when he inadvertently revealed that it was thought that some of the big banks were simply too big to go after as they might fail with dramatic adverse consequences for the financial system. These remarks he tried to back-track from later but the damage was already done.

SAC itself completely denies the charges and says “The handful of men who admit they broke the law does not reflect the honesty, integrity and character of the thousands of men and women who have worked at SAC over the past 21 years. SAC will continue to operate as we work through these matters, ” the statement concluded.