–

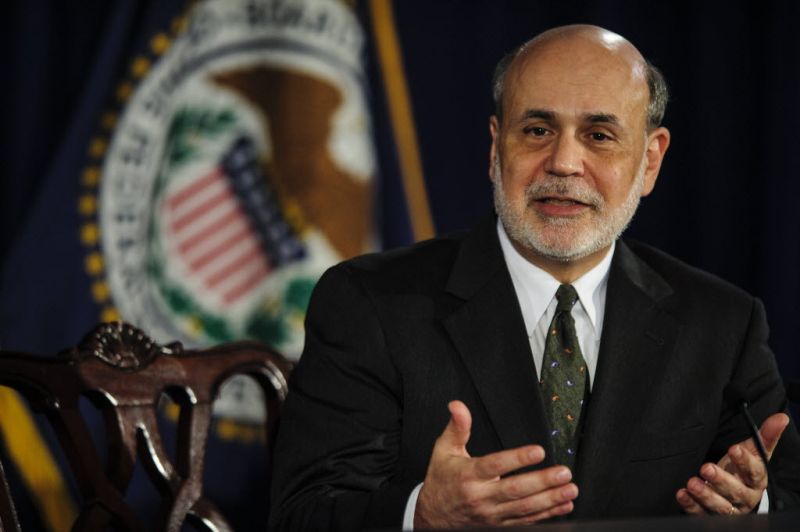

Ben Bernanke, chairman of the Federal Reserve/ Getty

Ben Bernanke, chairman of the Federal Reserve/ Getty

–

/ By David Frank /

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

Ben Bernanke, chairman of the Federal Reserve is testifying before Congress today and admitted that the Fed will begin to taper the massive $85 billion a month bond buying program, better known as QE2 later this year. He went on to say that the overall policy will remain dovish. This will policy will remain in effect as a stubborn unemployment rate, which remains above target, begins to decline slowly along with an inflation rate that remains below the central bank’s target. Because of this “the monetary policy will remain appropriate for the foreseeable future, ” Bernanke was quoted in a prepared release.

Bernanke says that as long as data continue to suggest a strengthening labor market along with inflation moving towards the 2 percent target, then tapering would begin sometime later this year but there is no “preset course.” Bernanke appears to be staying the course with previous remarks reaffirming that the Fed will reduce the size of its purchases starting soon. Tapering will continue through the first half of next year then ending mid year 2014. However, this will only happen if he U.S. economy continues to improve.

It should be pointed out that there is a clear difference between reducing QE2 and keeping an accommodative policy. Bernanke in his comments has made it clear the central bank relies very strongly on keeping a near short term interest rate policy along with other extremely low forward guidance rates in order to help spur the weak but slowly improving economy forward. This will continue as QE 2 ends and “even as the economic recovery strengthens and unemployment declines toward more-normal levels, ” Bernanke statement reads.

According to June’s forecasts, unemployment is expected to grow between 7.2 and 7.3 percent by the end of 2013. The Fed expects even better unemployment at the end of 2014, with a target between 6.8 and 6.5 percent. As of right now, unemployment is slowly improving and on target. The nation’s employment recovery has just begun and is at a “moderate pace, ” Bernanke said in the statement.

The Fed is expecting the economy to grow at 2.3 to 2.6 percent this year and in 2014, accelerate to 3.0 to 3.5.

In May, Bernanke rattled investors when his Congressional testimony indicated that the FRB would reduce the QE2 program within the next few meetings. This gave investors the wrong idea that the program would taper down by this September. In a corrective speech later, he said the program could end around mid-2014.

Bernanke will begin his testimony at 10 a.m. EST, and we expect no surprises and for him to stick to his pre testimony statement released earlier today.