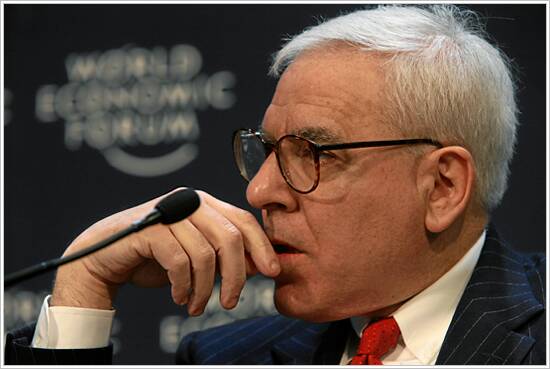

David Rubenstein head of Carlyle Group / Wikipedia

–

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

/ By Clive Minchom /

Reuters reported yesterday that the giant hedge fund Carlyle Group LP is thinking of trying to accomplish an IPO of CommScope Holding Company Inc, a telecommunications equipment provider, “two sources familiar with the matter said on Tuesday”. Carlyle bought the company lock-stock-and barrel and took it private for $3.9 billion less than three years ago.

Buy low, sell high is the mantra of markets and of the predators who roam relentlessly amongst them. Now with a healthier economy beginning to take hold again in the US, markets have recovered as well during 2013. Carlyle is accordingly speaking to investment banks about possibly listing CommScope as soon as this year given favorable market conditions, “the sources said”. It is still early days though, as Carlyle has not yet even hired underwriters to handle such a proposed offering, according to people, who asked not to be identified because the matter is not public – though obviously it is now that Reuters has disseminated the information.

Officially Carlyle has declined to comment and CommScope spokespeople did not respond to a request by Reuters for comment. Nevertheless the trial balloon is now well and truly launched and thoroughly communicated to the public, and decisions will now doubtless be made partly based on reactions to it. Even so it may not be a slam dunk as, after recent gains so far during 2013, equity and bond markets are now going through a period of frothiness now since the recent pronouncement by the US Federal Reserve, albeit pretty delphic, about possibly reining in quantitative easing at some point.

CommScope, which is based in Hickory, North Carolina, is a major manufacturer of cables that underpin high-speed data networks. Its origins go back to Superior Cable Corporation, a telephone cable company created in 1953, which changed ownership several times before going public in 1997.

Moody’s Investor Service Inc said in May it expected CommScope to show modest growth over the next twelve months, driven by wireless carriers spending on infrastructure. Revenues are expected to organically grow at 2 percent to 4 percent on average over the next several years, it added. The company had revenues of over $3 billion in the 12 months ending March 2013, according to Moody’s.

Just in May 2013, CommScope issued $550 million of payment-in-kind (PIK) notes that allow the company to pay interest payments to bondholders in more bonds rather than in cash, according to Thomson Reuters IFR. By saving cash the company was then able to separately pay Carlyle a dividend, which is something dear to the hearts of private equity investors.

JPMorgan Chase, Bank of America, Deutsche Bank AG , and Goldman Sachs Group Inc led the debt deal for CommScope in May, according to International Financing Review, indicating their relationships with the company which may spill over into an IPO it it indeed comes. JPMorgan also advised Carlyle on the acquisition of CommScope in the first place.

It seems other private equity firms are also exploring IPOs in companies that they invested in relatively recently, and there is plenty of talk of Preliminary Prospectae for IPOs either being filed or “possibly being about to be being filed” in the language of indirection. Actual road shows to then go out and sell the shares to live investors are of course another matter.

EP Energy LLC is also talking with banks about an IPO this year, for example, people familiar with the matter told Reuters last week. The oil and gas company was acquired just last year by a consortium led by Apollo Global Management LLC for $7.15 billion in the largest U.S. leveraged buyout of 2012.

However, concerns that U.S. interest rates may now rise may complicate plans for everyone thinking of going through with their IPO to re-liquify their investments. As one example, industrial and construction supplies company HD Supply Holdings Inc, which indeed includes Carlyle among its private equity investors, priced its IPO last week well below its expected range.

Capital market windows can shut as quickly as they can open, and only those who are nimble, ready with their paperwork and have a great story to tell that investors find both compelling and timely in relation to their needs are likely to proceed at the moment.

About Carlyle Group

Carlyle founded in 1987 as an investment banking boutique by five original partners with backgrounds in finance and government: William E. Conway, Jr., Stephen L. Norris, David M. Rubenstein, Daniel A. D’Aniello and Greg Rosenbaum. An American-based global asset management firm, specializing in private equity.

As of December 31, 2012, Carlyle had $170 billion in assets under management across 113 funds and 67 fund of fund vehicles. The firm has more than 1, 400 employees including 650 investment professionals, with offices in 33 countries globally. Carlyle has investments in over 200 companies and more than 250 real estate investments. Carlyle’s portfolio companies employ more than 650, 000 people worldwide. The firm has over 1, 500 limited partners in 75 countries.

Carlyle was ranked as the third largest private equity firm in the world. It had been ranked first in the 2007 listing.