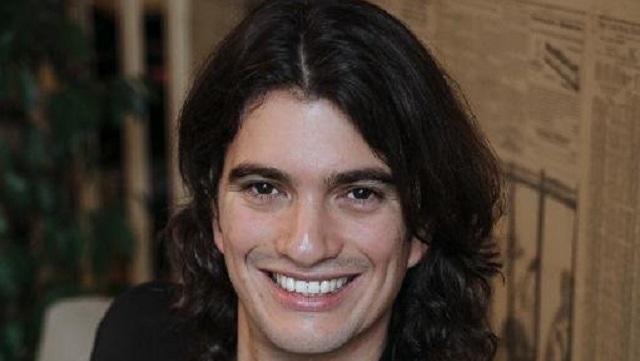

Adam Neumann, the controversial entrepreneur, is still looking to buy back WeWork, the now bankrupt company that he founded. Neumann submitted a $500 million bid for the company which was once worth as much as $47 billion.

Neumann first revealed his aspiration to regain WeWork in early February. At the time his new real estate venture Flow Global, together with Dan Loeb’s Third Point fund, were reported to be seriously interested in buying WeWork and have been making offers for it over the past few months. They even offered to finance the company during its bankruptcy in a way that would allow it to restart operations.

Bankruptcy does not mean the end for a firm. Many use bankruptcy protections to work on a restructuring plan. WeWork is still alive, at least on paper.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

“WeWork is an extraordinary company and it’s no surprise we receive expressions of interest from third parties on a regular basis,” WeWork said in a statement. “Our board and our advisors review those approaches in the ordinary course, to ensure we always act in the best long-term interests of the company.”

WeWork was founded in 2010 by Adam Neumann and Miguel McKelvey. The company quickly grew and became a unicorn, reaching a valuation of over $47 billion in 2019. However, WeWork’s IPO in 2019 was met with controversy due to concerns about its financials and corporate governance. The IPO was eventually withdrawn and WeWork was taken over by SoftBank, its largest investor.

The company once had a valuation of $47 billion. But in August, the NYSE suspended trading in the WeWork’s warrants because, said the exchange, its price was “abnormally low.” This came after the firm announced plans for a list ditch effort to save itself by offering a reverse stock split. And at that time WeWork stated that it would not appeal the move suspending trading of its warrants. Warrants are an equity derivative that gives the right, but not the obligation, to buy or sell a company’s shares.

In 2019, Neumann was forced out of WeWork, the company which he founded in 2010. After a meteoric rise, the entrepreneur was brought down after allegations of serious drug use and sexual improprieties were made. WeWork was forced to deal with sexual harassment suits. It delayed its planned IPO and laid off many workers.

But Adam Neumann reportedly walked away with a $1.7 billion deal. And so he used this money to acquire real estate and invest in a few new ventures.