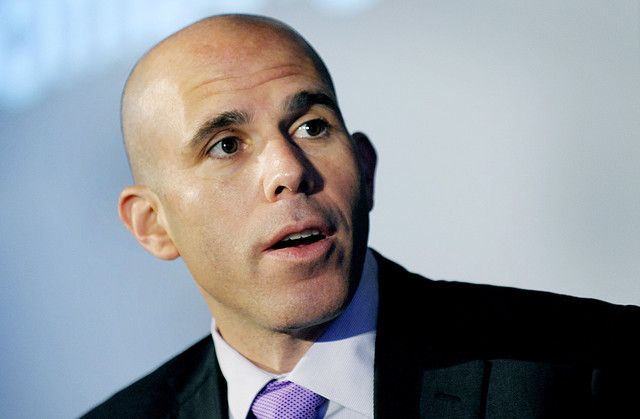

The Blackstone Group partnered with RXR Realty in its $1.2 billion acquisition of the Helmsley Building at 230 Park Avenue and holds a minority stake in the tower, RXR’s CEO Scott Rechler told The Real Deal.

RXR announced the acquisition in May, but at the time no partners on the deal were revealed. A source close to Blackstone confirmed the joint venture arrangement. It wasn’t immediately clear how large the fund manager’s stake is, how much it paid for it, or which if its real estate funds was involved.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

RXR and Blackstone bought the 1.4 million-square-foot, 34-story office building located just north of Grand Central Terminal from a partnership between Invesco, Monday Properties and South Korea’s Pension Service. Monday Properties had bought the tower for $1.15 billion at the height of the last market cycle in 2007, at the time with different partners.

This isn’t the first time the two firms partnered up. In February, RXR sold a 50 percent stake in a portfolio of New York office buildings to Blackstone, valuing the properties at a combined $4 billion.

Read the full story: click here

The Real Deal By Konrad Putzier