by Contributing Author

The pandemic has created an uncertain financial climate for millions of people worldwide. With inflation reaching all-time highs and jobs becoming less secure each month, it’s difficult to feel good about the future regarding finances. If you’ve been affected by economic disruption, the following are some tips on how to cope with the worries you might be feeling.

Focus On What You Can Control

It’s easy to spend time worrying about things we cannot control. Increasing interest rates, escalating inflation, the recent hikes in fuel prices…these are all worrying things, but we should not be losing sleep over them. Instead of thinking about what will happen if the price of grain continues to soar, focus on things you can change and control.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

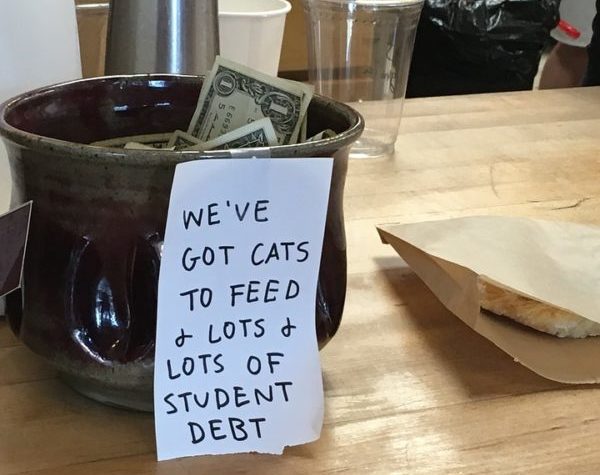

Do you have student debt? Have you looked into student loan refinancing? You might get lower interest rates and better repayment terms. Is there a way you can clear your credit card debt? This will be one less bill coming in each month. Can you lower your monthly spending by cutting back on eating out? The key here is to take action on the aspects of your finances you control.

Determine What Is Essential

Everyone is making some changes to cut back on the essentials. The first step is to determine what is necessary for your household. Essential living expenses include lighting, heating, food, rent/accommodation, clothing, transportation, and healthcare.

After that, look at how much you pay for cable, internet, insurance, and subscriptions. Do you need to pay $10 per month for Netflix? Are you using the gym that you’re paying $120 per month to? Does it make more financial sense to share a car with your partner? Are you making enough money working to offset the costs you’re paying for daycare? These are all questions you need to ask yourself to determine what is essential and what isn’t.

Track Your Income and Expenses

You will never be able to fully cope with financial stress without knowing where you stand financially. You need to know how much money comes into your household each month, and you need to know where every cent of that amount is spent. You also need to know how much debt you owe and what the repayment terms are. Learn how to budget and download an app on your phone to do it on the go. After just weeks of budgeting, you’ll feel much more at ease.

Talk It Out

The effects of financial stress are significant, and debt is a huge burden to carry on your own. Don’t let it get the better of you, as the consequences can be detrimental. Instead of shedding tears in bed at night, confide in someone you trust. If you don’t have someone that you feel comfortable talking to, reach out to a professional who might be able to offer you some expert advice. You’ll be surprised at the different avenues that will offer you help when you go looking.