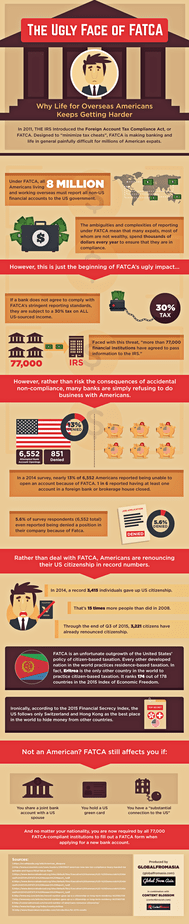

The Ugly Face of FACTA: Why Life for Overseas Americans Keeps Getting Harder In 2011, THE IRS Introduced the Foreign Account Compliance Act, or FACTA. Designed to “minimize tax cheats”, FACTA is making banking- and life in general- painfully difficult for millions of American expats.

Under FACTA, all 8 million or so Americans living and working overseas must report all non-US financial accounts to the US government.(1)

The ambiguities and complexities of reporting under FACTA mean that many expats, most of whom are not wealthy, spend thousands of dollars every year to ensure that they are in compliance.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

However, this is just the beginning of FACTA’s ugly impact…

If a bank does not agree to comply with FACTA’s stringent reporting standards, they are subject to a 30% tax on ALL US-sourced income.

Faced with this threat, “more than 77, 000 financial institutions have agreed to pass information to the IRS.” (2)

However, rather than risk the consequences of accidental non-compliance, many banks are simply refusing to do business with Americans.

In a 2014 survey, nearly 13% of 6, 552 Americans reported being unable to open an account because of FACTA. 1 in 6 reported having at least one account in a foreign bank or brokerage house closed. (4)

5.6% of survey respondents (6, 552 total) even reported being denied a position in their company because of Facta. (5)

Rather than deal with FACTA, Americans are renouncing their US citizenship in record numbers.

In 2014, a record 3, 415 individuals gave up US citizenship. (6)

That’s 15 times more people than did in 2008. (7)

Through the end of Q3 of 2015, 3, 221 citizens have already renounced citizenship. (8)

FACTA is an unfortunate outgrowth of the United States’ policy of citizen-based taxation. Every other developed nation in the world practices residence-based taxation. In fact, Eritrea is the only other country in the world to practice citizen-based taxation. It ranks 174 out of 178 countries in the 2015 Index of Economic Freedom. (9)

Ironically, according to the 2015 Financial Secrecy Index, the US follows only Switzerland and Hong Kong as the best place in the world to hide money from other countries. (10)

Not an American? FACTA still affects you if:

-You share a joint bank account with a US spouse

-You hold a US green card

-You have a “substantial connection to the US”

And no matter your nationality, you are now required by all 77, 000 FACTA-compliant institutions to fill out a FACTA form when applying for a new bank account.

The Ugly Face of FATCA, How Its Affecting Americans Abroad – An infographic by the team at Global From Asia

Resources

- https://en.wikipedia.org/wiki/American_diaspora

- http://www.economist.com/news/leaders/21605907-americas-new-law-tax-compliance-heavy-handed-inequitable-and-hypocritical-fatcas-flaws

- https://www.democratsabroad.org/sites/default/files/Executive%20Summary%20-%20Democrats%20Abroad%202014%20FATCA%20Research%20Report_1.pdf

- https://www.democratsabroad.org/sites/default/files/Executive%20Summary%20-%20Democrats%20Abroad%202014%20FATCA%20Research%20Report_1.pdf

- https://www.democratsabroad.org/sites/default/files/Executive%20Summary%20-%20Democrats%20Abroad%202014%20FATCA%20Research%20Report_1.pdf

- http://www.wsj.com/articles/record-number-gave-up-u-s-citizenship-or-long-term-residency-1423582726

- http://www.wsj.com/articles/record-number-gave-up-u-s-citizenship-or-long-term-residency-1423582726

- http://conservativeread.com/record-number-of-americans-renounce-citizenship/

- http://www.heritage.org/index/country/eritrea

- http://www.financialsecrecyindex.com/introduction/fsi-2015-results