Samsung’s founding Lee family controls South Korea’s largest industrial conglomerate, and it does so partly with the help of a variety of Samsung cross-holdings among its subsidiary and affiliated companies. The family exercises effective control therefore despite holding only a fairly small percentage of the main parent company’s shares.

As part of a bid to consolidate the family’s control position, one Samsung company, Cheil Industries, is currently bidding to merge with another Samsung company, Samsung C&T.

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

The Samsung group comprises more than sixty companies altogether. C&T itself owns over $10 billion worth of a number of the group’s affiliates shares. That includes, for example, shares in the group’s jewel in the crown, Samsung Electronics Co – making control of C&T itself pivotal to control of the whole group. By merging into Cheil Industries the Lee family clearly hopes to cement its own control as they prepare for the next generation of family leadership to take over from their ailing Chairman, 73 year old Lee Kun-hee.

While local Korean regulators have been, perhaps not surprisingly, generally supportive of the merger, which is scheduled for a shareholder vote July 17th, the international investor community is more skeptical.

Both North American corporate governance review bodies, Institutional Shareholder Services and Glass Lewis and Co., have recently come out against valuations for the deal, ISS saying “Management’s revenue targets are “hugely optimistic” and “how such targets could be achieved remain unclear.”

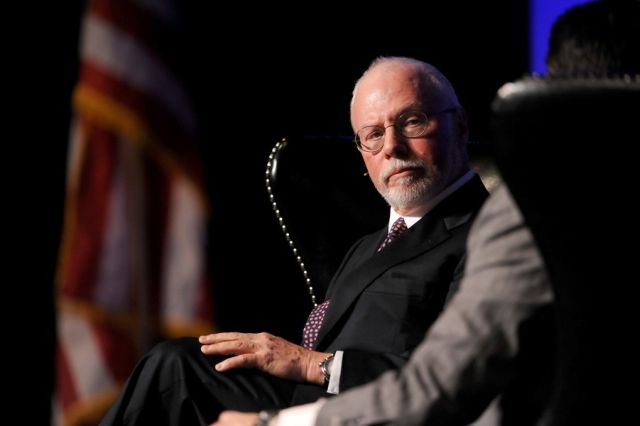

The activist investor Paul Singer‘s Elliott Associates, which owns some Samsung C&T shares, is practically apoplectic in its opposition and has been opposing the transaction in the courts since early in June. In the dry language of investing Elliott Associates LP has welcomed the ISS support and stated publicly. “We’re obviously pleased with the ISS recommendations, which clearly validate our concerns about the proposed merger, ”

Altogether the Lee family controls close to 20 percent of Samsung C&T’s shares when you also take other Samsung cross holdings into consideration. In court filings Elliott has been arguing that the proposed merger would basically just give away about $7 billion of C&T book value to Cheil, without adequate payment therefor.

Lately the court actions, which are taking place in Korea, which is of course Samsung’s home turf, have turned quite ugly. The Korea Herald is reporting that local prosecutors have launched an investigation into allegations that Elliott may have actually fabricated information in a regulatory filing.

As the third-largest shareholder of Samsung C&T, which is also a public company, with a 7.1 percent stake, Elliott has been seeking to thwart Samsung’s plan to merge C&T into Cheil Industries – Cheil seems to be the de facto holding company for the Lee family interests. The Korea Herald reports that Samsung C&T officials are claiming they believe Elliott coloured its regulatory report to substantiate the hedge fund’s claim that the proposed 1: 0.35 stock swap ratio between Cheil and Samsung C&T would damage the interests of Samsung C&T shareholders, including of course Elliott.

Elliott was also criticized in Korea last week when the company posted a mistranslated transcript of a meeting it held with Samsung C&T back in February. According to Samsung, the transcript quoted a Samsung C&T official as saying the firm did not consider any merger that would negatively affect shareholders’ interest. But the quote actually came from Elliott’s side, and was a mistranslation of “Samsung should not consider such a merger.” “We admit that it was not translated precisely, and made corrections on that immediately after the finding, ” Elliott’s local spokesman Hwang Nu-Ri is quoted as saying. “It was a rough translation, with no intention of fabricating information.”

Sounds like a diversionary storm in a tea cup, and we wait the outcome of the main battle with some interest. Elliott is certainly no push-over, but neither is Samsung and it is on home ground.