–

–

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

The Carlyle Group has just signed a definitive agreement to buy the Industrial Packaging Group (IPG), a division of Illinois Tool Works, for US$3.2 billion.

IPG is a global manufacturer of strap, stretch, and protective packaging consumables, tools and equipment for the shipping of goods. The transaction is subject to customary regulatory approvals and is expected to close in the middle of 2014.

Headquartered in Glenview, Illinois, in America’s mid-western heartland, IPG is nevertheless global in scope, has 88 manufacturing locations on six continents and serves 45 countries. The company has a well-established track record in its markets, and claims a hundred-year history of innovation at Signode, one of IPG’s primary strap packaging brands.

Equity for the transaction will come from Carlyle Partners VI, its latest US$13 billion U.S. Buyout fund. Financial leverage is expected to be substantial, as is typical for such buy-outs, and Carlyle has already secured debt financing commitments for the deal from a banking syndicate made up of JP Morgan, Goldman Sachs, BofA Merrill Lynch, Barclays, Citigroup and Credit Suisse.

–

–

Carlyle has previously invested more than US$9 billion of its own equity in many industrial transactions around the globe, transforming each of them into more efficient and capable companies along the way.

Brian Bernasek, Managing Director of The Carlyle Group, said, “IPG is a highly diversified business with strong management, attractive market positions and excellent free cash flow. We will leverage Carlyle’s global network to support the Company’s growth, and we look forward to helping IPG achieve its full potential as it transitions to a standalone company.”

Illinois Tool Works is now on track to divest many of its non-core businesses and Scott Santi, its President and Chief Executive Officer, said “We are pleased to announce the sale of the Industrial Packaging segment as this represents the last major step in refocusing our portfolio…” adding, “The Industrial Packaging business is an industry leader with a strong management team and highly dedicated people. We thank them all for their many contributions to ITW and know they will continue to thrive as an investment of The Carlyle Group.”

According to Reuters the deal was priced at 8.5 times estimated forward EBITDA for 2014, which seems to be the standard price these days for a half decent business with some growth potential, even where cost cutting or other improvements are required.

Ironically, in choosing to sell to Carlyle, ITW is believed to have shut out a bid from Toronto based competitor to Carlyle for these kinds of deals, Onex Corp in conjunction with the deep pocketed Canada Pension Plan Investment Board.

It was only the other day Carlyle also bought up Diversified Group Asset Management (DGAM) from Toronto, right under Onex’s nose.

About The Carlyle Group

The Carlyle Group is a global alternative asset manager, kisted on Nasdaq, with US$185 billion of assets under management across 122 funds and 81 fund of funds vehicles at September 30th, 2013.

Carlyle invests in a number of business segments and has expertise in various industries, including: aerospace, defense & government services, consumer & retail, energy, financial services, healthcare, industrial, technology & business services, telecommunications & media and transportation.

The Carlyle Group employs more than 1, 450 people in 34 offices across six continents.

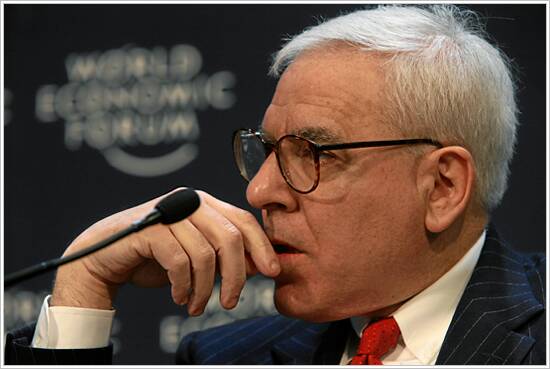

About David Rubenstein

David Rubenstein was born and raised in Baltimore, Maryland. He graduated from Duke University in Durham, North Carolina before going on to earn his law degree at the University Of Chicago Law School.

After graduation Rubenstein went on to practice law with Paul, Weiss, Rifkind, Wharton & Garrison in New York, and later became domestic policy advisor to President Jimmy Carter during the late seventies.

After Carter lost the Presidency to Ronald Reagan, Rubinstein established his own private law practice, before going into partnership with William E. Conway, Jr. and Daniel A. D’Aniello to form the Carlyle Group in 1987 as an alternative asset management and investment company.

Rubenstein is estimated to have a net worth of US$3 billion, and is recognized as being a member of the Giving Pledge, a group of wealthy Americans who have pledged to donate more than half of their wealth to philanthropic causes or charities during their lifetime.

–