–

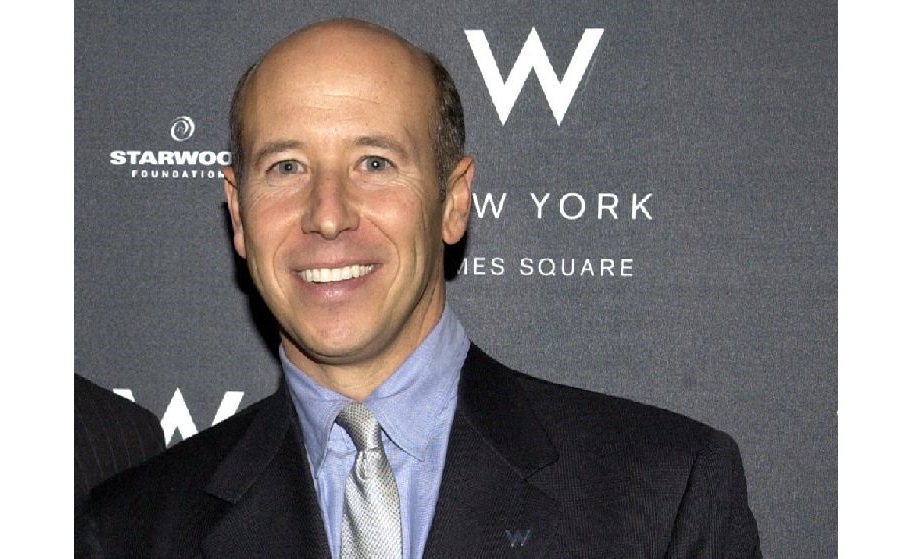

Barry S. Sternlicht who is Chairman of Starlight Capital, and a major current shareholder of TRI Pointe

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

–

TRI Pointe Homes of Irvine Cailifornia today announced that it had signed a definitive agreement to acquire the home building subsidiary of Weyerhaeuser the giant timber conglomerate, in a transaction valued at US$2.7 billion.

The acquisition will make TRI Pointe one of the ten largest home builders in the United States, and they will acquire from Weyerhaeuser five distinct market-leading brands with operations in key regional growth markets for home building. These are:

• Pardee Homes – Southern California and Las Vegas;

• Trendmaker Homes – Texas;

• Maracay Homes – Arizona;

• Winchester Homes – Washington, DC metro area; and

• Quadrant Homes – Puget Sound region of Washington State.

Together the units acquired own or control 27, 000 home building lots. Tri Pointe hitherto has been mainly a California builder.

–

–

The deal is expected to close before the end of June 2014 and will be accomplished by way of a complicated manoeuvre known as a “Reverse Morris Trust.” Under this arrangement Weyerhaeuser will first spin out its home building subsidiary to its shareholders as a new entity, which will then simultaneously merge with a subsidiary of TRI Pointe. The Weyerhaeuser spin-off will be the surviving entity in the merger and then continue as a wholly owned subsidiary of TRI Pointe. Under these structural arrangements the transaction is expected to be tax free to both sides.

The Weyerhaeuser shareholders of the spin-off will receive as consideration 130 million shares of TRI Pointe common stock, valued currently at US$2 billion and a cash payment of US$700 million. After closing TRI Pointe will then have in total about 161 million outstanding common shares, so the former Weyerhaeuser shareholders will hold a little over 80% of the new entity reflecting the fact that the Weyhaeuser subsidiary is actually much larger than TRI Pointe itself.-

Even so, existing Tri Pointe management will manage the new entity and Doug Bauer, Tom Mitchell and Mike Grubbs will continue to serve as Chief Executive Officer, President and Chief Operating Officer and Chief Financial Officer, respectively of the surviving entity. In addition TRI Pointe’s headquarters will remain in Irvine, California.

Barry S. Sternlicht who is Chairman of Starlight Capital, and a major current shareholder of TRI Pointe, will also continue as Chairman of the Board of the expanded TRI Pointe and Doug Bauer will also continue as a Director. TRI Pointe will enlarge its Board from seven to nine directors and Weyerhaeuser will have the right to select four of the nine directors for appointment to the new Board once the deal closes.

“Our Board of Directors has determined that combining Weyerhaeuser Real Estate Company with TRI Pointe creates the greatest value for our shareholders, ” said Doyle Simons, Weyerhaeuser’s President and Chief Executive Officer.

–

–

“Today’s announcement is an important milestone for our organization as it transforms TRI Pointe into one of the leading players in the homebuilding industry, ” said Doug Bauer, TRI Pointe Chief Executive Officer.

“Doug and the management team have built TRI Pointe rapidly through a dedication to innovative designs and strong customer commitment, ” said Barry Sternlicht, Chairman of the Board of TRI Pointe. “Both organizations share a disciplined, hands-on approach, leveraging strong local market relationships, and they have established reputations for delivering quality homes on budget and on schedule to drive shareholder value.”

From a strategic standpoint TRI Pointe considers the deal will bring it a lot of benefits, especially in the perennially tight California housing markets. It puts it this way:

• Enhanced Geographic Presence:

TRI Pointe will significantly broaden its geographic footprint with the addition of Weyerhaeuser’s operations and local market leadership, providing entry into high-growth markets that exhibit favorable long-term economic and demographic fundamentals. These markets include Houston, Phoenix, Tucson, Las Vegas, Southern California, the Washington DC metro area, Richmond, and the Puget Sound region of Washington State.

• Deeper California Footprint:

The addition of Pardee Homes will deepen TRI Pointe’s footprint considerably in key lot-constrained Southern California counties including Los Angeles, San Diego, Riverside, and San Bernardino. Each is a market where TRI Pointe has extensive local knowledge and key land developer relationships.

• Expanded Land Holdings:

Through the transaction, TRI Pointe will increase its land inventory by gaining control of Weyerhaeuser’s approximately existing 27, 000 building lots. More than 16, 000 of these lots are located in lot-constrained California markets where TRI Pointe has strong knowledge and an established history of success. The added land holdings also provide optionality for future land and lot sales.

• Best-in-Class Management Team:

In addition to TRI Pointe’s executive management team, TRI Pointe will gain an experienced senior management team, operating five distinct homebuilders, each with an average of 21 years operating experience in their regional markets. These teams have unparalleled local knowledge and relationships in their respective markets.

• Increased Market Capitalization & Liquidity:

The transaction will increase TRI Pointe’s market capitalization (on the NYSE) and shares outstanding, and improve its access to the capital markets. Additionally, the combined company will benefit from strong margin contribution from Weyerhaeuser’s assets, which are being transferred into the expanded entity at book value.

In today’s recovering housing markets in the US, it may very well be the additional access to capital markets, which the larger combined entity will likely have easier access to, that is one of its most attractive features.

Markets reacted well to the announcement of the deal, pushing TRI Pointe shares up by over 6% as of the time of writing. Barry Strernlicht’s Starlight Capital’s holding in TRI Pointe will be diluted down from 38% to about 7.5% after this deal closes. If the values are going up he won’t mind a bit. One can even say this transaction appears to be business and financial engineering at its most constructive.

–