–

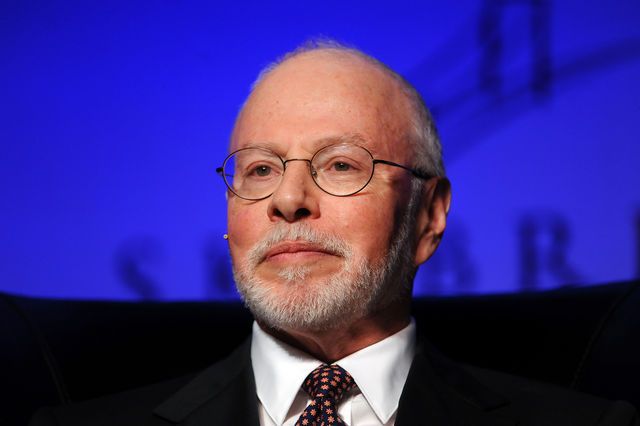

Paul Singer / Getty

Will you offer us a hand? Every gift, regardless of size, fuels our future.

Your critical contribution enables us to maintain our independence from shareholders or wealthy owners, allowing us to keep up reporting without bias. It means we can continue to make Jewish Business News available to everyone.

You can support us for as little as $1 via PayPal at office@jewishbusinessnews.com.

Thank you.

–

The liquidators of bankrupt Lehman Brothers European operations yesterday announced that its outstanding claim against its’ UK operations had been sold to hedge fund manager Paul Singer’s Elliott Management Corp. for£650 million (about US$1 billion), and King Street Capital Management.

The face value of the claims Elliott Management and King Street Capital will receive is approximately £1.25 billion however, (about US$2 billion), meaning the hedge fund complex could potentially double its money as Lehman Brothers completes its long liquidation process and realizes what is left of its assets.

“I believe that the transaction represents an excellent outcome for the company’s creditors, ” Derek Howell, the joint administrator overseeing Lehman Brothers’ British assets for Price Waterhouse Coopers (“PwC”), said in a statement… “I am hopeful that it will lead to an early resolution of the outstanding issues ….” This may of course be something of a hopeful assessment.

When Lehman Brothers went bankrupt in 2008 it almost brought down the world’s financial system. Hundreds of billions of dollars were lost in the fall out, not least by the many holders of claims against Lehman itself, both in the US in Europe and elsewhere – a total of more than US$650 billion was owed by Lehman globally at the time of the bankruptcy.

And yet quietly and methodically the official liquidators of the failed bank around the world have been selling off what was left of the assets and selling off some of the claims against it to vulture funds for pennies on the dollar. The UK liquidator PwC even estimated at some point that all claims against the UK arm of Lehman could even end up being paid in full, an example indeed where the unit had not been insolvent but just cash flow deficient and therefore unable to meet its claims on time.

Accordingly, buying Lehman claims has, for some, been one of the best financial investments of the past few years, and particularly so for a select group of big vulture fund investors who bought them aggressively.

Four large American hedge funds – Paul Singer’s Elliot Management, Brian Higgins’ and Francis Biondi’s King Street Capital, commodities giant Cargill’s investment unit CarVal and Wall Street legend Seth Klarman’s Baupost – now stand to make billions of dollars in profit from Lehman.

Over a sustained period these groups have snapped up big tranches of the bank’s debts at knock-down prices in one of the biggest vulture swoops in history. Yesterday’s deal with Paul Singer is just the most recent. In doing so, too, they have probably helped Lehman’s creditors, large and small, escape years of paralysis as the liquidators have systematically and patiently tried to collect what they could on the assets, also earning huge fees for themselves in the process as well.

For example PwC, liquidators of Lehman Brothers International Europe, faced about US$80 billion of unsecured claims after the bankruptcy. Five years ago these claims – held by clients, other banks, or even other parts of the Lehman business – traded at barely 20 cents on the dollar. Today that has gone up to over 80 cents and could even still be rising. Yesterday’s deal with Paul Singer brings an end of the process much closer hence justifying the substantially larger discount offered by the liquidators. Paul Singer is helping finish the job for them, essentially.

Buying distressed debt is an expert’s game based partly on extremely rigorous analysis of what assets might yield, often in balance sheets with very complicated accounting edifices constructed around them which have to be dissected carefully, and completely understood; only then to be compared to the claims against them and with allowance for a sometimes very long period of time to collect.

It is also a game predicated on an appetite and enthusiasm for engaging in aggressive litigation, sometimes in a variety of courts in many parts of the world, with disparate legal systems to boot, once a position has been taken. Finally an ability to persist for a very long time if necessary in order to prevail – hanging on like a barnacle clings to the hull of a ship – becomes a hugely desirable character trait.

And then finally only at the end, particularly in cases where sovereign debt is involved, a diplomatic nose is essential to sense the precise timing to engage in some delicate negotiations to bring about a successful dénouement. One whereby all parties can claim victory but the vulture investor can go home with the cash.

Paul Singer would certainly recognize these attributes, and even see in some of them a reflection of himself I am sure.

–